2018-04-02 07:33:00 Monday ET

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable att

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

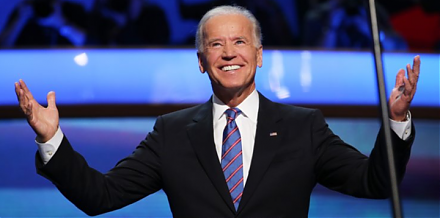

2019-05-05 10:34:00 Sunday ET

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

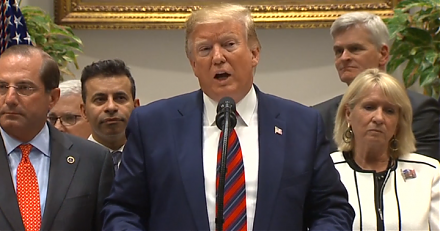

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2019-10-17 08:35:00 Thursday ET

The European Central Bank expects to further reduce negative interest rates with new quantitative government bond purchases. The ECB commits to further cutt