2017-06-27 05:40:00 Tuesday ET

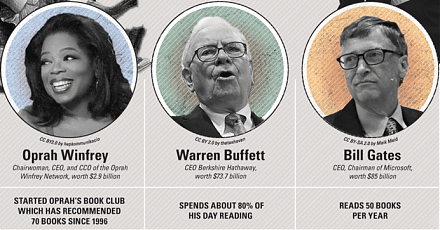

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2018-11-23 09:39:00 Friday ET

Former White House chief economic advisor Gary Cohn points out that there is no instant cure for the Sino-U.S. trade dilemma. After the U.S. midterm electio

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)

2026-10-31 12:38:00 Saturday ET

Today tech titans and billionaires continue to reshape global pharmaceutical investments for both better healthspan and longer lifespan. We discuss, desc

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham