2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2019-06-07 04:02:05 Friday ET

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutic

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.

2018-02-01 07:38:00 Thursday ET

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries t

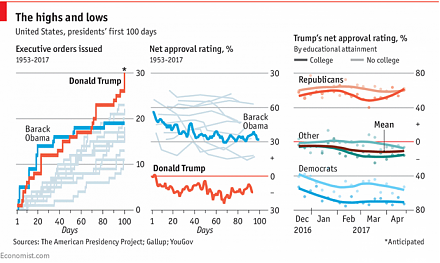

2017-04-25 06:35:00 Tuesday ET

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.