2017-08-01 09:40:00 Tuesday ET

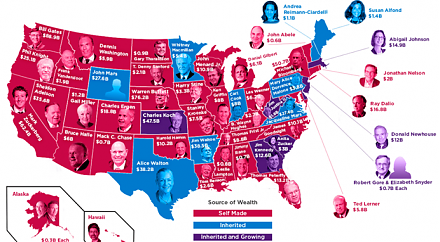

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2017-08-13 09:36:00 Sunday ET

Several investors and billionaires such as George Soros, Warren Buffett, Carl Icahn, and Howard Marks suggest that the time may be ripe for a major financia

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work