2022-10-15 09:34:00 Saturday ET

Internal capital markets and financial constraints Duchin (JF 2010) empirically finds that multidivisional firms with robust internal capital markets ret

2023-02-28 11:30:00 Tuesday ET

The Biden Inflation Reduction Act is central to modern world capitalism. As of 2022-2023, global inflation has gradually declined from the peak of 9.8% d

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive

2017-03-03 05:39:00 Friday ET

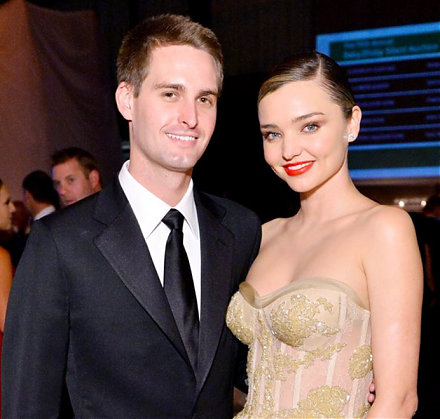

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti