2017-12-23 10:40:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from their urgent work, slow down, and invest in free activities such as reading non-fiction books with long-term payoffs in greater knowledge, creativity, and energy. As a result, these top performers achieve less in a day at first, but drastically more over the course of their lives. Like compound interest, this wise investment is *compound time* because a small investment yields surprisingly large returns over time. This idea echoes Ben Franklin and Paul Tudor Jones:

(a) An investment in knowledge pays the best interest; and

(b) Intellectual capital will always trump financial capital.

These world-famous investors and billionaires share 5 key hacks for leading a productive and efficient lifestyle with frugal habits and norms:

Hack #1: Keep a journal of key daily accomplishments.

Hack #2: Take a nap to enhance memory and creativity.

Hack #3: Walk 15 minutes per day for better relaxation.

Hack #4: Read non-fiction books to sharpen the saw.

Hack #5: Interact with conversation partners.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-19 09:39:00 Tuesday ET

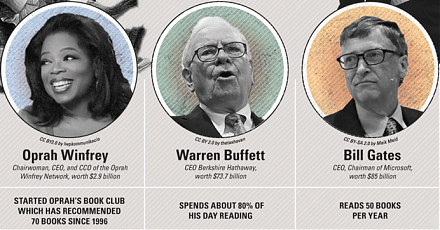

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2019-11-07 14:36:00 Thursday ET

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Org

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2018-09-19 12:38:00 Wednesday ET

The Trump administration imposes 10% tariffs on $200 billion Chinese imports and expects to raise these tariffs to 25% additional duties toward the end of t

2019-05-21 12:37:00 Tuesday ET

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a