2023-04-14 13:32:00 Friday ET

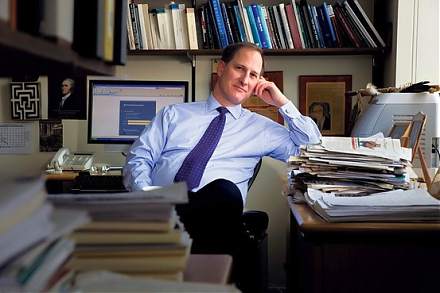

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

2018-10-30 10:41:00 Tuesday ET

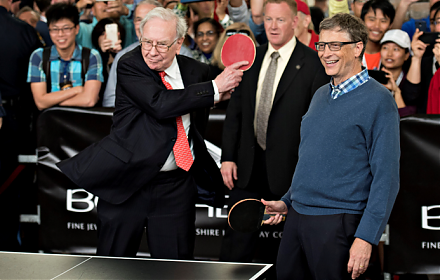

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2022-05-30 09:32:00 Monday ET

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a

2019-03-05 10:40:00 Tuesday ET

We may need to reconsider the new rules of personal finance. First, renting a home can be a smart money move, whereas, buying a home cannot always be a good