Home > Library > AYA analytic report on global technological developments October 2025

Author James Campbell

Our fintech finbuzz analytic report shines light on the current global technological advancements. As of Fall-Winter 2025, this report delves into the latest advances in medications for obesity treatment and weight loss treatment. We can expect the global market for new obesity and weight loss medications to reach $100 billion by 2030 as more insurers cover these new medications, GLP-1s, because they show promise in treating some other common diseases such as heart diseases, diabetes, and some types of cancers. For obesity and weight loss treatment, the U.S. patient population is likely to grow to 70 million people in due course. Broader GLP-1 drug adoption can meaningfully boost U.S. economic growth. Nonetheless, the resultant wider GLP-1 insurance coverage would cost the U.S. government much money.

Description:

Our fintech finbuzz analytic report shines light on the current global technological advancements. As of Fall-Winter 2025, this report delves into the latest advances in medications for obesity treatment and weight loss treatment. We can expect the global market for new obesity and weight loss medications to reach $100 billion by 2030 as more insurers cover these new medications, GLP-1s, because they show promise in treating some other common diseases such as heart diseases, diabetes, and some types of cancers. For obesity and weight loss treatment, the U.S. patient population is likely to grow to 70 million people in due course. Broader GLP-1 drug adoption can meaningfully boost U.S. economic growth. Nonetheless, the resultant wider GLP-1 insurance coverage would cost the U.S. government much money.

The new third-generation GLP-1 medications for obesity treatment and weight loss treatment, Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, now begin to become more prevalent and more pervasive worldwide. These medications show far higher weight loss efficacy than prior first-generation and second-generation medications. The latest GLP-1 medications further show long prevalent safety track records for the treatments of diabetes, heart diseases, and several kinds of cancers. However, the current U.S. prices for these new GLP-1 medications are extremely high (about $15,000 per patient per year). In the meantime, not all people with obesity can take these new GLP-1 medications because they are now prohibitively costly and U.S. insurance coverage remains partial and incomplete. Despite these current hurdles, obstacles, and impediments for broader GLP-1 drug adoption, we now expect the global market for GLP-1 obesity and weight loss medications to grow substantially to benefit more than 1 billion people with obesity worldwide by 2030.

GLP-1 medications are the first in a long history of weight loss medications to target the critical brain pathways that regulate both food intake and energy storage. As a result, GLP-1 patients feel less hungry and so crave food much less. As the third-generation medications for obesity treatment, these new GLP-1 medications often lead to 23%-25% average weight losses among GLP-1 patients (versus the single-digit average weight losses of prior medications).

While GLP-1 medications show tremendous promise in weight loss treatment, the global market for these new medications remains only a fraction of all of the people with obesity worldwide. Some patients are not medically able to take these GLP-1 medications, especially since each of these medications requires an injection by a needle. Also, these latest GLP-1 medications are shown to be effective only when patients continue to take these medications almost on a daily basis. A current lack of comprehensive insurance coverage by Medicare, Medicaid, and private insurers remains a major obstacle to wider GLP-1 drug adoption and usage in America and other countries. The current healthcare insurance programs only cover GLP-1s for the wider treatments of obesity-driven diseases such as diabetes, heart diseases, and some types of cancers, but there is now no insurance coverage solely for the treatment of obesity alone.

In addition to supply chain shortages and bottlenecks for GLP-1 mass production, the current hurdles, obstacles, and impediments impose hard high-cost limits and constraints on the size of the global market for GLP-1 medications in the near-to-medium term. Some recent estimates show that the U.S. GLP-1 patient population is likely to grow substantially from 2 million people with obesity today to at least 15 million people with obesity in 2030 (about 15% of the U.S. adults with obesity). On the basis of these recent estimates, we can now expect the global market for GLP-1 medications to increase substantially from $10 billion today to almost $100 billion by 2030.

Over the next few years, we expect U.S. employer insurance coverage for GLP-1 medications to increase substantially from approximately 50% of U.S. employers today due to greater U.S. employee healthcare needs and the significantly positive health benefits of GLP-1 medications. As several pharmaceutical titans direct their R&D efforts into some further developments of GLP-1 medications, it is reasonable for investors to expect more intense competition to result in lower prices for GLP-1 medications. Further, the new GLP-1 treatments of other obesity-driven diseases, specifically heart diseases, diabetes, and some types of cancers etc, can go a long way in empowering Medicare, Medicaid, and numerous private insurers to broaden their health insurance coverage of GLP-1 medications. In the meantime, however, U.S. Congress prohibits Medicare and Medicaid from covering GLP-1 medications today because of their budget-busting sky-high prices.

We can expect U.S. health insurance coverage to broaden substantially if the new GLP-1 medications show promise in treating serious health conditions well beyond obesity. Additional health conditions can include heart diseases, diabetes, as well as some kinds of cancers. The FDA’s recent approval of Novo Nordisk’s Wegovy, semaglutide, for the treatment of heart diseases has led to Medicare coverage of Wegovy for this new indication. Current studies for the treatments of sleep apnea, liver impairment, and other diseases can result in similarly favorable outcomes of broader Medicare coverage of GLP-1 medications. Some recent positive estimates show that the wider GLP-1 treatments of diseases can probably benefit 70 million obese U.S. patients by 2030. These positive ripple effects and chain reactions can cause greater economic benefits beyond the biotech and pharmaceutical sectors. As a result of GLP-1 medications with higher weight-loss efficacy, U.S. adults with prior obesity would have substantially greater and broader needs and demands for day-to-day food items, beverages, many other consumer staples, beauty products, and even air travel round-trips.

With the concomitant positive health improvements, the next widespread adoption of GLP-1 medications can cause better economic growth, employment, and labor productivity in America. U.S. GDP can probably rise by 0.5 to 2 percentage points in the long run if at least 30 million U.S. adults with obesity take these medications. Specifically, U.S. GDP can increase more substantially by 1.35 to 2.55 percentage points if all 70 million U.S. adults with obesity take such medications. However, the American government would face fiscal strain if both Medicare and Medicaid start to provide complete health insurance coverage to 40% of U.S. adults with obesity. This fiscal strain would likely amount to $1 trillion per year if all 40% of U.S. adults with obesity take GLP-1 medications at the current high prices ($15,000 per patient per year). This dollar amount is about the current size of Medicare and about 20% of how much Americans spend on healthcare each year. Although there are clear health benefits for U.S. adults with obesity to take GLP-1 medications, broad health insurance coverage would be enormously expensive for the U.S. government. We believe the next wave of GLP-1 technological advancements can help alleviate this fiscal concern for smarter and better healthcare solutions to weight loss treatments in due course.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession

2023-08-07 12:29:00 Monday ET

Oxford macro professor Stephen Nickell and his co-authors delve into the trade-off between inflation and unemployment in the dual mandate of price stability

2023-04-07 12:29:00 Friday ET

Timothy Geithner shares his reflections on the post-crisis macro financial stress tests for U.S. banks. Timothy Geithner (2014) Macrofinanci

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2017-08-01 09:40:00 Tuesday ET

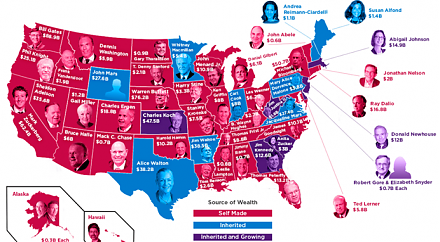

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N