Home > Library > AYA analytic report on the top tech titans (FAMGA) May 2020

Author Monica McNeil

As of Spring-Summer 2020, this report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan.

Description:

As of Spring-Summer 2020, this report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan.

Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2018-08-09 16:36:00 Thursday ET

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclea

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2018-01-12 07:37:00 Friday ET

The Economist delves into the modern perils of tech titans such as Apple, Amazon, Facebook, and Google. These key tech titans often receive plaudits for mak

2018-05-09 08:31:00 Wednesday ET

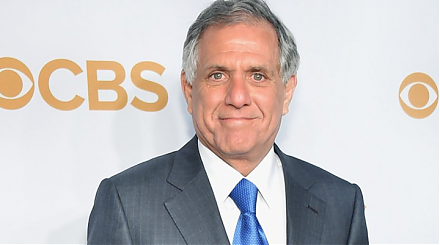

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached