Home > Library > Asset pricing theory and empirical corporate finance

Author Andy Yeh Alpha

This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance. The former focuses on fresh empirical asset pricing tests (e.g. Fama-French factor models), asset pricing models with Epstein-Zin recursive investor preferences, behavioral stock return momentum patterns, and supplementary asset pricing model review notes. The latter delves into many topics in empirical corporate finance such as capital structure, corporate ownership and governance, corporate investment, corporate innovation, net equity issuance, corporate diversification, cash management, corporate payout, and so forth. These surveys and annotations are useful and convenient for the typical graduate student who specializes in modern finance.

macrofinance asset return prediction fama-french capital equity premium puzzle john cochrane corporate finance peter demarzo epstein-zin behavioral finance size value momentum capital structure capital investment corporate ownership and governance corporate innovation cash management corporate payout net equity issuance corporate diversification

Description:

This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance. The former focuses on fresh empirical asset pricing tests (e.g. Fama-French factor models), asset pricing models with Epstein-Zin recursive investor preferences, behavioral stock return momentum patterns, and supplementary asset pricing model review notes. The latter delves into many topics in empirical corporate finance such as capital structure, corporate ownership and governance, corporate investment, corporate innovation, net equity issuance, corporate diversification, cash management, corporate payout, and so forth. These surveys and annotations are useful and convenient for the typical graduate student who specializes in modern finance.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2025-10-09 11:30:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

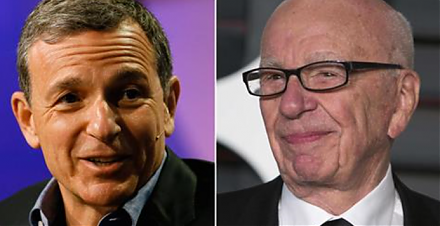

2017-10-21 08:45:00 Saturday ET

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities