Home > Library > Asset pricing theory and empirical corporate finance

Author Andy Yeh Alpha

This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance. The former focuses on fresh empirical asset pricing tests (e.g. Fama-French factor models), asset pricing models with Epstein-Zin recursive investor preferences, behavioral stock return momentum patterns, and supplementary asset pricing model review notes. The latter delves into many topics in empirical corporate finance such as capital structure, corporate ownership and governance, corporate investment, corporate innovation, net equity issuance, corporate diversification, cash management, corporate payout, and so forth. These surveys and annotations are useful and convenient for the typical graduate student who specializes in modern finance.

macrofinance asset return prediction fama-french capital equity premium puzzle john cochrane corporate finance peter demarzo epstein-zin behavioral finance size value momentum capital structure capital investment corporate ownership and governance corporate innovation cash management corporate payout net equity issuance corporate diversification

Description:

This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance. The former focuses on fresh empirical asset pricing tests (e.g. Fama-French factor models), asset pricing models with Epstein-Zin recursive investor preferences, behavioral stock return momentum patterns, and supplementary asset pricing model review notes. The latter delves into many topics in empirical corporate finance such as capital structure, corporate ownership and governance, corporate investment, corporate innovation, net equity issuance, corporate diversification, cash management, corporate payout, and so forth. These surveys and annotations are useful and convenient for the typical graduate student who specializes in modern finance.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-05-03 11:29:00 Friday ET

Key tech unicorns blitzscale business niches for better scale economies from Uber and Lyft to Pinterest, Slack, and Zoom. LinkedIn cofounder and serial entr

2018-02-27 09:35:00 Tuesday ET

Fed's new chairman Jerome Powell testifies before Congress for the first time. He vows to prevent price instability for U.S. consumers, firms, and finan

2018-09-11 18:36:00 Tuesday ET

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $

2019-04-21 10:07:54 Sunday ET

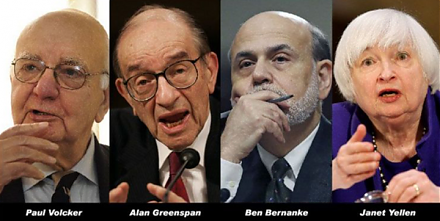

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2018-11-09 11:35:00 Friday ET

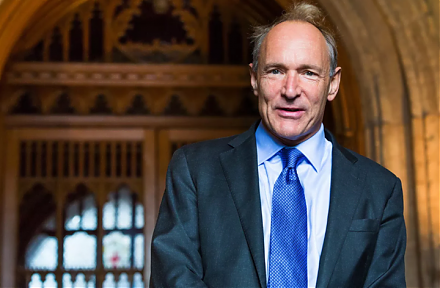

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2019-09-23 12:25:00 Monday ET

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit