Home > Library

Search results : taxation

2025-10-15This ebook delves into the AI-driven comprehensive fundamental analysis of each of the top 20 tech titans in terms of their competitive advantages, economic moats, and technological innovations.

2024-02-14This ebook delves into key financial topics and stock market investment articles.

2022-09-21This ebook delves into key financial topics and stock market investment articles.

2020-06-06This ebook delves into key financial topics and stock investment memes blog posts and essays.

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

2018-11-19 09:38:00 Monday ET

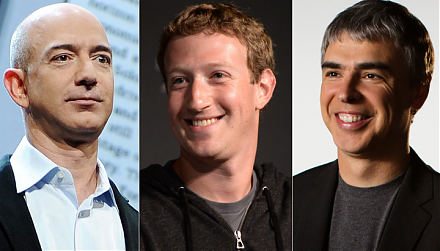

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-08-02 17:39:00 Friday ET

The Phillips curve becomes the Phillips cloud with no inexorable trade-off between inflation and unemployment. Stanford finance professor John Cochrane disa

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod