Home > Library

Search results : monetary policy

2023-03-14This USPTO patent publication delves into our algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

2023-03-03This research article delves into mutual causation between stock market alphas and macroeconomic innovations.

2023-02-01Our fintech finbuzz analytic report shines fresh light on the current global macro economic outlook.

2022-10-22This ebook delves into the modern collection of prescient economic insights with executive annotations and personal reflections.

2022-09-21This ebook delves into key financial topics and stock market investment articles.

2022-08-01Our fintech finbuzz analytic report shines fresh light on the current global macro economic outlook.

2022-04-14This ebook delves into the modern collection of prescient New Keynesian macro economic insights with personal annotations and reflections.

2022-03-18This ebook delves into the modern collection of prescient macro economic insights with personal annotations and reflections.

2022-02-01Our fintech finbuzz analytic report shines fresh light on the current global macro economic outlook.

2021-12-05This ebook delves into the modern collection of prescient economic insights with executive annotations and personal reflections.

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2019-11-01 12:31:00 Friday ET

Kourtney Kardashian shares the best money advice from her father. This advice reminds her that money just cannot buy happiness. As the eldest of the Kardash

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

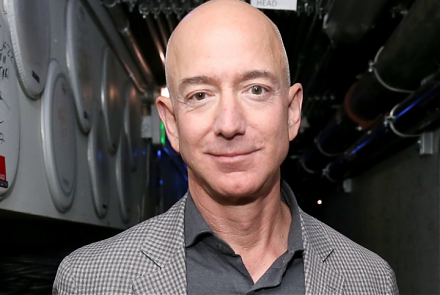

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

2019-09-13 10:37:00 Friday ET

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S.