2019-09-05 09:26:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

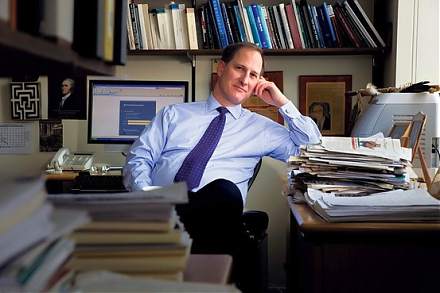

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. First, the Chinese Xi administration would never lose legitimacy due to subpar 5.5%-to-6.3% real GDP economic growth. China retains more fiscal and monetary policy levers than global growth headwinds. Second, Chinese hawkish hardliners remain patient and methodical when they deal with external wildcards. These external wildcards include U.S. partisanship and economic policy uncertainty, Brexit trade and capital exodus, and diplomatic outrage in the South China Sea.

Third, the 5G tech titan HuaWei is a big deal and national champion for China. As China seeks to trudge on the long march toward tech supremacy, U.S. tech trade strategists should consider alternative approaches instead of the current legalistic approach to Sino-U.S. trade conflict resolution. It would be a symbolic loss of state dignity and sovereignty for China to agree to signing into law U.S. trade terms and conditions on intellectual property protection and enforcement. Alternatively, U.S. trade reps should focus on direct dispute negotiations between U.S. and Chinese tech corporations through the extant inland and international arbitration tribunals. This alternative mechanism may nevertheless favor domestic firms in China.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-19 12:38:00 Wednesday ET

The Trump administration imposes 10% tariffs on $200 billion Chinese imports and expects to raise these tariffs to 25% additional duties toward the end of t

2018-08-07 07:33:00 Tuesday ET

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and produc

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2017-09-19 05:34:00 Tuesday ET

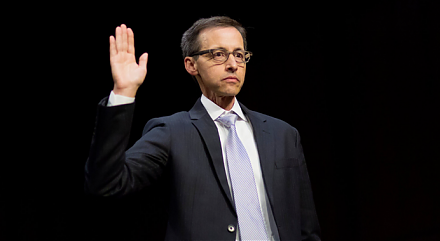

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el