Home > Library

Search results : default probability

2020-12-31This simulation study delves into the quantitative effects of the recent proposal for more robust bank capital adequacy.

2013-06-06This research article proposes a new algorithmic model for credit portfolio segmentation.

2012-12-12This research article empirically shows the mysterious and inexorable nexus between credit default swap spreads and interest rate surprises.

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2022-11-05 11:32:00 Saturday ET

CEO overconfidence and corporate performance Malmendier and Tate (JFE 2008, JF 2005) argue that overconfident CEOs are more likely to initiate mergers an

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2018-01-12 07:37:00 Friday ET

The Economist delves into the modern perils of tech titans such as Apple, Amazon, Facebook, and Google. These key tech titans often receive plaudits for mak

2019-06-19 09:27:00 Wednesday ET

San Francisco Fed CEO Mary Daly suggests that trade escalation is not the only risk in the global economy. Due to the current Sino-U.S. trade tension, the g

2017-08-01 09:40:00 Tuesday ET

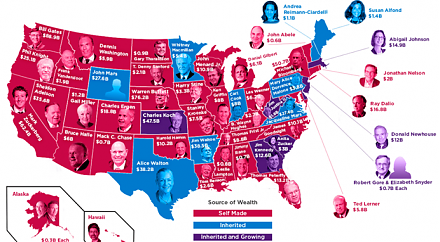

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N