Home > Library

Search results : asset return prediction

2018-10-11The current invention pertains to the novel, non-obvious, and applicable design and development an algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

2015-08-07This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance.

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2019-01-02 06:28:00 Wednesday ET

New York Fed CEO John Williams listens to sharp share price declines as part of the data-dependent interest rate policy. The Federal Reserve can respond to

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2020-03-26 10:31:00 Thursday ET

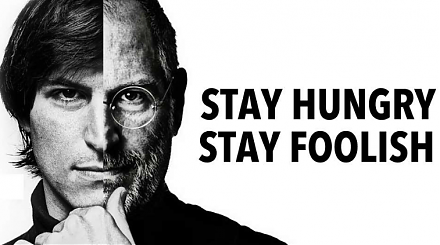

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading