Home > Library > Algorithmic system for dynamic conditional asset return prediction and fintech network platform automation

Author Andy Yeh Alpha

The current invention pertains to the novel, non-obvious, and applicable design and development an algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

Description:

The current invention pertains to the novel, non-obvious, and applicable design and development an algorithmic system for dynamic conditional asset return prediction and fintech network platform automation. Core technicality entails the consistent estimation of dynamic conditional alphas after the econometrician controls for at least 6 fundamental factors such as market risk, size, value, momentum, asset growth, and operating profitability through recursive multivariate filtration. Conditional specification test and historical backtest evidence supports the use of the dynamic conditional multi-factor asset return prediction model against the alternative static models. The fintech network platform empowers users to interact with one another by transmitting valuable units of financial intelligence and information in an online social network. The information units include dynamic conditional alpha rank order, key financial ratio summary, quadripartite visualization of financial data, and financial statement analysis etc. The fintech network platform automates social network functions for better interactive engagement through minimum viable cloud computation for mobile app design.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

2018-07-23 07:41:00 Monday ET

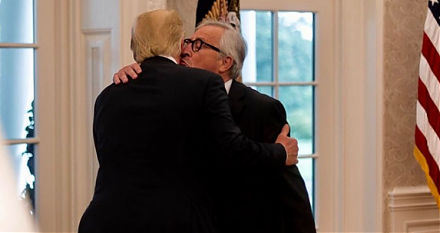

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2018-01-13 08:39:00 Saturday ET

The Economist digs deep into the political economy of U.S. government shutdown over 3 days in January 2018. In more than 4 years since 2014, U.S. government

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2018-05-05 07:33:00 Saturday ET

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GA

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work