Home > Library > Macroeconomic theory and evidence in practice

Author Andy Yeh Alpha

This book presents many useful mathematical exercises in postgraduate macroeconomic theory and practice. Many quantitative exercises, examples, codes, and solutions draw from the collective wisdom of macroeconomic books by Acemoglu, Barro, Lucas, Prescott, Romer, and Sargent. The reader can benefit from these solutions with many mathematical equations and notations to become familiar with the core curriculum for postgraduate macroeconomic theory and practice. The core topics cover baseline macroeconomic time-series analysis, Lucas critique, Kydland-Prescott time-inconsistency problem of rule versus discretion, Solow-Swan steady-state growth model, Friedman permanent income hypothesis, human capital accumulation, investment-specific technological progress, recursive successive approximation, first-order Euler equation, transversality condition, Bellman dynamic programming optimization, Arrow-Debreu initial competitive equilibrium, sequential competitive equilibrium, recursive competitive equilibrium, Krusell skill-capital complementarity and skill-driven income inequality, Lucas tree asset pricing model, Mehra-Prescott equity premium puzzle, Barro fiscal stabilization, Ricardian equivalence theorem, dynamic stochastic general equilibrium (DSGE), Cass-Koopmans-Ramsey (CKR), real business cycle (RBC), and so forth.

stock market technology daron acemoglu robert barro robert lucas edward prescott david romer thomas sargent christopher sims olivier blanchard jordi gali roger farmer macroeconomic time-series vector autoregression real business cycle new keynesian phillips curve taylor interest rate rule solow-swan economic growth model steady state lucas critique dynamic stochastic general equilibrium keynesian search theory friedman permanent income hypothesis capital bellman dynamic programming optimization recursive competitive equilibrium equity premium puzzle fiscal stabilization ricardian equivalence skill-capital complementarity

Description:

This book presents many useful mathematical exercises in postgraduate macroeconomic theory and practice. Many quantitative exercises, examples, codes, and solutions draw from the collective wisdom of macroeconomic books by Acemoglu, Barro, Lucas, Prescott, Romer, and Sargent. The reader can benefit from these solutions with many mathematical equations and notations to become familiar with the core curriculum for postgraduate macroeconomic theory and practice. The core topics cover baseline macroeconomic time-series analysis, Lucas critique, Kydland-Prescott time-inconsistency problem of rule versus discretion, Solow-Swan steady-state growth model, Friedman permanent income hypothesis, human capital accumulation, investment-specific technological progress, recursive successive approximation, first-order Euler equation, transversality condition, Bellman dynamic programming optimization, Arrow-Debreu initial competitive equilibrium, sequential competitive equilibrium, recursive competitive equilibrium, Krusell skill-capital complementarity and skill-driven income inequality, Lucas tree asset pricing model, Mehra-Prescott equity premium puzzle, Barro fiscal stabilization, Ricardian equivalence theorem, dynamic stochastic general equilibrium (DSGE), Cass-Koopmans-Ramsey (CKR), real business cycle (RBC), and so forth.

Although this book does not serve as an attempt to cover all relevant areas of postgraduate macroeconomic theory and practice, this book encapsulates myriad hard and solid exercises that require mathematical logic to derive macroeconomic results. The editor puts a great emphasis on macroeconomic intuition and analytical rigor for the reader to better appreciate the substantive content of postgraduate macroeconomic theory and practice. This content spans at least a full year of twin sequential courses on macroeconomic theory and practice.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2025-06-05 00:00:00 Thursday ET

Former New York Times team journalist and Pulitzer Prize winner Charles Duhigg describes, discusses, and delves into how we can change our respective lives

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2017-07-13 08:35:00 Thursday ET

President Donald Trump has announced that a major Apple iPhone upstream supplier, Foxconn Technology Group (aka Hon Hai Precision Group), will invest $10 bi

2017-11-17 09:42:00 Friday ET

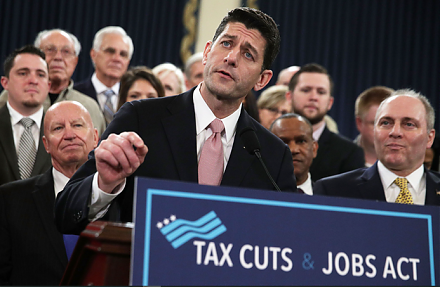

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2024-10-31 09:26:00 Thursday ET

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to enhance human lives with better productivity.

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has