2017-06-21 05:36:00 Wed ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in several ways.

First, his long-term buy-and-hold method does not apply to special cases that warrant an immediate exit strategy. For instance, Warren Buffett has sold major equity stakes in AT&T, Deere, P&G, IBM, and most importantly, Walmart.

Second, Warren Buffett expects medium-term consolidation and transformation within the air transport industry. For this reason, he retains substantial equity stakes in Delta, South West, and United Continental Airlines.

In regard to the latter major stock sale, Warren Buffett praises the recent rise and success of Amazon (i.e. Walmart's closest online retail rival).

Third, Warren Buffett simply laughs at his own *stupidity* in neglecting the epic ecommerce success of Amazon, Alibaba, Google, and Apple. While he retains an active interest in Apple as now the world's largest corporation and dividend payer, Buffett thinks that he needs a cultural change in his ambivalent attitude toward technology stocks with decent fundamental prospects.

Overall, these points help clarify the common misconception of Warren Buffett's long-term buy-and-hold value investment strategy.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-23 12:25:00 Monday ET

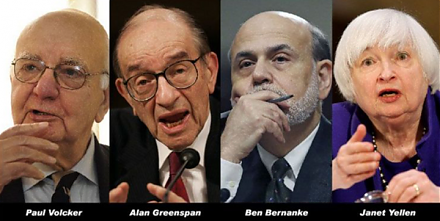

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2019-02-01 15:35:00 Friday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implem

2018-10-09 08:40:00 Tuesday ET

The International Monetary Fund (IMF) appoints Harvard professor Gita Gopinath as its chief economist. Gopinath follows her PhD advisor and trailblazer Kenn

2023-10-19 08:26:00 Thursday ET

World politics, economics, and new ideas from the Psychology of Money written by Morgan Housel We would like to provide both economic and non-economic th

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President