2018-01-05 07:37:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living standards in the next decades. His top 2 secrets to U.S. wealth creation are innovation and productivity. The former encapsulates key technology transfer in education, health care, finance, communication, and so on. The latter involves labor-augmenting productivity gains that can readily turn into real GDP economic growth.

As the CEO and Chairman of Berkshire Hathaway, Warren Buffett has a net worth of $85 billion as of early-2018. He is a generous philanthropist who has given away more than $27 billion in the past decade. This multi-billionaire is well-known for his frugal habits, enjoys daily McDonald's breakfasts, and insists on using his favorite flip phone. Buffett prefers to invest in bluechip value stocks or public companies with high ratios of book-to-market equity, dividend-to-price, and net-profit-to-price.

Buffett believes that sound corporate governance contributes to both better market valuation and operating performance with competitive moats. Berkshire Hathaway beats most mutual funds and asset management firms etc with an impressive 19% average annual return. Buffett's value investment strategy focuses on buying the common stocks of public corporations that operate as profitable cash cows with conservative asset growth.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2020-03-26 10:31:00 Thursday ET

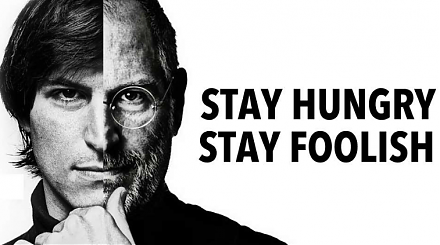

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2018-04-29 13:44:00 Sunday ET

College education offers a hefty 8.8% pay premium for each marginal increase in the number of years of intellectual attainment in contrast to the 5.6%-6% lo

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an