2019-04-05 08:25:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in American Express and Goldman Sachs, and both stocks sharply trail S&P500 in recent years. Meanwhile, Berkshire Hathaway owns another $40 billion in Apple. Buffett focuses not on Apple revenue growth from quarter to quarter, but rather the broad network of hundreds of millions of iPhone and iPad users worldwide. Goldman experiences transient stock market undervaluation due to its notorious involvement in the 1MBD Malaysian bond scandal (which may result in fines up to several billions of dollars). Also, American Express executes several strategic partnerships in e-commerce payments, and continues to face fierce competition from the other major credit card bellwethers Visa and MasterCard.

Buffett views this unique collection of U.S. stocks as a set of public companies that Berkshire Hathaway partly owns in the long run. Without excessive levels of debt, these stocks earn 15%-20% steady profits on net tangible equity capital that Buffett requires to run the stock investment business. Berkshire Hathaway experiences a healthy fundamental increase in the market value of common stock investments from $170 billion to almost $173 billion from 2017-2018 to early-2019.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-01 06:30:00 Friday ET

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2017-08-01 09:40:00 Tuesday ET

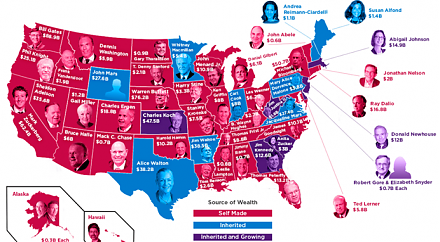

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2019-05-19 19:31:00 Sunday ET

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achiev

2018-07-05 13:40:00 Thursday ET

U.S. trading partners such as the European Union, Canada, China, Japan, Mexico, and Russia voice their concern at the World Trade Organization (WTO) in ligh

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind