2019-03-19 12:35:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple, Netflix, and Twitter (FAMGANT). Most PhD economists exhibit at least 2 critical skills that can contribute to effective business solutions. First, many economists implement effective empirical methods and quantitative tools to ferret out *causal relations* in business data. Second, PhD economists can understand the useful design of both *effective incentives and market mechanisms* for better business optimization. In practice, these PhD economists help demystify many empirical puzzles in the tech sector. For instance, some economists empirically find that Uber Express Pool may inadvertently draw in active users from some other Uber products without growing the full Uber user base. Also, several other economists show that eBay tends to syphon off people who would have come through organic search when the online auction website advertises on Google. Moreover, some recent economic research demonstrates that many African-American Airbnb users experience rampant racial discrimination.

If tech platforms involve matching users or businesses, market design economists can likely help guide these key business decisions. Modern examples of disruptive platform design include Amazon, Airbnb, Tinder, TripAdvisor, and so forth. If scale economies are critical for the business, several major mergers, acquisitions, and exclusive deals may dramatically alter the strategic industry structure and market environment. For instance, Apple and Alphabet are the dominant duo in the iOS-Android market for mobile devices; Microsoft remains a primary software market player with its Office Suite and Windows operating system; Intel and Qualcomm specialize and dominate in the tech-savvy market for microchips; Google acquires 90% of U.S. online search traffic; Facebook extracts healthy profits in social media advertisements; and Netflix retains competitive moats and niches in the lucrative business of high-speed original video content distribution.

If tech companies need to analyze large-scale user data to make better business decisions, econometricians apply logistic regressions, panel estimation methods, and time-series models to derive informative business insights into user behaviors, product reviews, and customer interests and preferences. Smart data analyzers include Amazon, Apple, Facebook, Twitter, eBay, PayPal, and IBM etc. In contrast to doctors, engineers, and lawyers who may focus on specific mechanical details and techniques, most economists focus on the bigger picture when they implement empirical methods to solve practical business problems. Overall, most economists can see both the trees and the forest in important business decisions when push comes to shove.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5

2019-08-20 07:33:00 Tuesday ET

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minis

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2025-10-10 12:31:00 Friday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-31 14:39:00 Saturday ET

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2018-09-09 13:42:00 Sunday ET

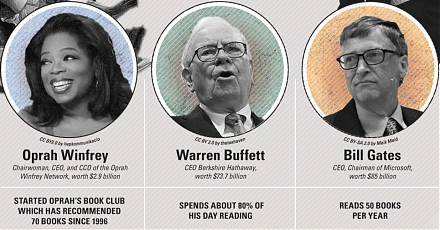

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca