2019-02-17 14:40:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% richest adults own about 25% of total household wealth in America (in accordance with a similar economic inequality situation back in the 1920s).

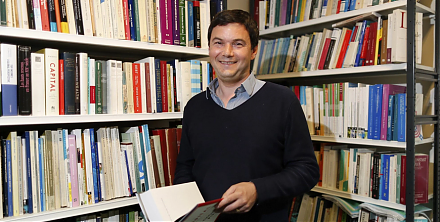

When we broaden the core definition of the upper socioeconomic echelon, the top 1% richest households own 40% of national wealth as of 2016. This high wealth share compares with the 25%-30% thresholds back in the 1980s. Over the past 30 years, the bottom 90% household wealth share has significantly declined in similar proportions. Russia is the only comparable country with similar wealth inequality. The current Zucman empirical study resonates with the main themes of persistent global economic inequality in the recent book, Capital in the new century, written by Thomas Piketty. The root causes of U.S. income and wealth inequality include information technology adoption, elite education, high-skill human capital shortage, and talent concentration.

The government can design affordable college and graduate school education for young adults to better prepare for their vocational pursuits. Ubiquitous information technology adoption allows fresh talents to better appreciate the knowledge-driven productivity gains from robotic automation, artificial intelligence, and smart data analysis etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2017-07-01 08:40:00 Saturday ET

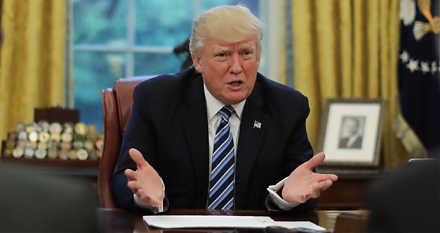

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo