2017-01-17 12:42:00 Tue ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational corporations may have inadvertent consequences.

This Bloomberg news article and video clip summarize Summers's critiques in several bullet points.

When these corporations repatriate offshore cash, this cash is unlikely to be spent on domestic job creation and R&D innovation.

This cash might go into greater empire-driven M&A expansion, opportunistic low-cost share buyback, and financial reorganization.

This managerial hubris can translate into bigger bonuses and cash windfalls for many senior executive managers to the detriment of minority shareholders.

This managerial rent protection not only entrenches key corporate blockholders but also exacerbates income and wealth inequality in Corporate America.

The supply-side tax cuts and infrastructure expenditures move beyond voodoo economics with extraordinary uncertainty.

Can Trump's economic policy reforms prove their worth in due course?

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2018-09-29 12:39:00 Saturday ET

The Securities and Exchange Commission (S.E.C.) sues Elon Musk for his August 2018 tweet that he has secured external finance to convert Tesla into a privat

2022-05-25 09:31:00 Wednesday ET

Net stock issuance theory and practice Net equity issuance can be in the form of initial public offering (IPO) or seasoned equity offering (SEO). This l

2019-12-07 11:30:00 Saturday ET

China turns on its 5G telecom networks in the hot pursuit of global tech supremacy. China Telecom, China Unicom, and China Mobile disclose 5G fees of $18-$2

2017-12-01 06:30:00 Friday ET

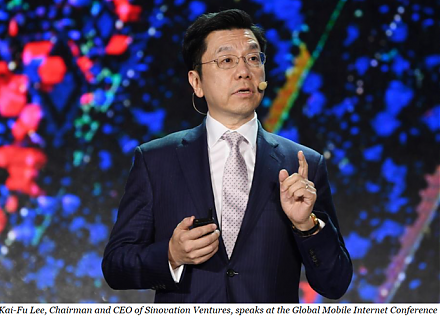

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo