2018-01-15 07:35:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic Forum, Mnuchin now praises the steady greenback devaluation that helps promote competitive U.S. export prices. This praise adds noise to the status quo as Trump seeks to withdraw from the North American free trade agreement, the Paris climate change accord, and the Trans-Pacific Partnership. Canadian, French, and Indian prime ministers accuse the Trump administration of unfair protectionism that trade deficits beget tariffs, quotas, and even embargoes.

Trumpism prevails in the face of international reprehension when the weaker dollar reaches a 3-year trough and gold prices rise to the highest level in about 2 years. Throughout the Reagan, Clinton, Bush, and Obama administrations, we associate each sharp greenback depreciation with key fiscal stimulus, export expansion, and subsequent interest rate hike. In order to resolve the twin deficit problem (i.e. both fiscal deficit and trade deficit), the Federal Reserve needs to raise the interest rate further to attract capital flows from abroad.

It is important for the Trump team to attract foreign investors to buy Treasury bonds to finance the perennial U.S. fiscal debt and deficit. Key exchange rate stabilization remains a hot pursuit for both U.S. policymakers and regulators to serve in the best interests of American workers and investors.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2018-08-07 07:33:00 Tuesday ET

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and produc

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m

2025-10-02 12:31:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2024-03-19 03:35:58 Tuesday ET

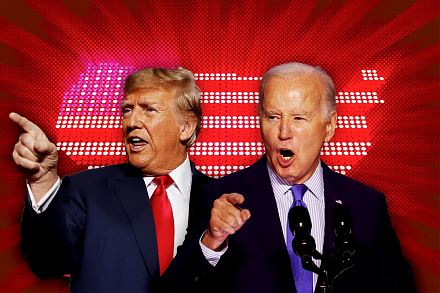

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative