2017-08-01 09:40:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in New York, and Mark Zuckerberg in California. Indeed, all of these billionaires are great fundamental investors too.

Through Berkshire Hathaway, Buffett invests in finance, energy, transportation, technology, retail service, and so forth.

Gates invests in Microsoft, software technology, cloud service provision, as well as philanthropy.

Zuckerberg invests in building Facebook as the world's largest social network with more than 2 billion active users.

Bloomberg invests in financial data delivery and media service with worldwide fame and ubiquity.

This infographic visualization does not include several other famous self-made billionaires, entrepreneurs, financiers, and investors such as Jeff Bezos, Tim Cook, Mark Cuban, and Larry Page.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-07-01 08:40:00 Saturday ET

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2023-05-14 12:31:00 Sunday ET

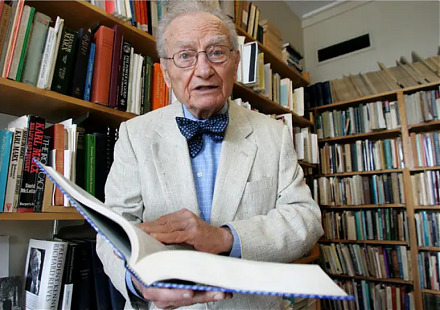

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2019-02-28 20:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube February 2019 In this podcast, we discuss several topical issues as of February 2019: (1) our proprieta

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2025-08-02 13:31:00 Saturday ET

Chip Espinoza, Mick Ukleja, and Craig Rusch shine fresh light on the core competences for managing millennials as part of the new modern workforce in recent