2018-01-04 07:36:00 Thu ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequality accelerates in America. The top 3% own 54% of U.S. wealth, whereas, the bottom 90% own only 24% of U.S. wealth. The top 3% rake in a much greater proportion of total income in comparison to the prior state back in 2010, whereas, the bottom 90% earn proportionately less now. U.S. income and wealth concentrate in white citizens, homeowners, and upper social echelons with high educational attainment.

This economic inequality between the rich and the poor also prevails in Britain, China, Japan, Australia, New Zealand, France, Germany, and some other parts of the Euro zone. Populist politics would seem to have become a natural reaction to this worldwide inequality in light of Brexit, Trump presidential election victory, and strongman rule by Putin, Xi, and Duterte. Pundits and policymakers can consider several solutions such as income tax credit, greater public investment in education, more progressive wage-versus-capital income tax treatment, and less residential segregation. A radical solution involves what Professor Thomas Piketty proposes as global capital taxation. The latter may affect international capital flows as Tobin taxes lower the average after-tax rate on capital investments in different countries.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-11 10:28:00 Saturday ET

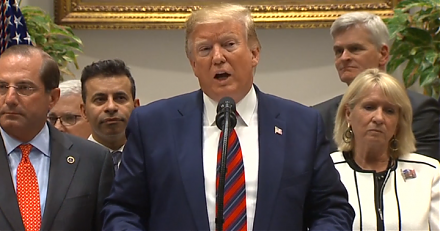

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0

2017-07-13 08:35:00 Thursday ET

President Donald Trump has announced that a major Apple iPhone upstream supplier, Foxconn Technology Group (aka Hon Hai Precision Group), will invest $10 bi

2019-08-09 18:35:00 Friday ET

Nobel Laureate Joseph Stiglitz maintains that globalization only works for a few elite groups; whereas, the government should now reassert itself in terms o

2019-08-01 11:33:00 Thursday ET

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. po