2020-03-26 10:31:00 Thu ET

technology apple artificial intelligence patent intellectual property trademark copyright proprietary assets flywheel team dynamism team leaders perseverance resilience smart collaboration founders senior managers passion rare resources reinvention purpose vision holistic product development steve jobs iphone ipad

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development.

Jay Elliot (2012)

Leading Apple with Steve Jobs: management lessons from a controversial genius

In this book, the author Jay Elliot delves into the unique controversial management style and legacy of Steve Jobs at Apple. As a former vice president at Apple, Elliot offers an anecdotal inside view of Jobs leadership, culture, creativity, and legacy on smart product development. Founders and entrepreneurs who wish to emulate the business success of Apple can find an overview of changes that these leaders want to see in their own companies.

In accordance with the bold vision of Steve Jobs, it is important for senior business leaders to design great smart products and services that they can change society. Communicating this bold vision is as important as developing new products and services. Also, it is important for business leaders to cultivate a unique corporate culture that highly values employees as the best intangible asset. Team leaders often recruit fresh talents that match well the unique culture of business innovation. Moreover, simple and intuitive product design serves as an essential part of how each smart product or mobile device works in practice. Apple designs key products and services in a unique way that most users find it intuitive and simple to operate these mobile devices regardless of age and technical ability. Smart product design should result in customer delight but not client frustration.

Senior managers must balance day-to-day operations to play an advisory role in steering the organization toward business success and innovation. As Steve Jobs would suggest, it is important for senior team leaders to use casual conversations, interviews, and technical details to ferret out the genuine intentions and potential contributions of each job candidate well beyond what looks good on paper. From time to time, tech titans from Apple and Amazon to Facebook and Google need to set the industry standards with the first-mover competitive advantage (e.g. Apple and the iPhones, iPads, iPods, and iTunes; Amazon and the e-commerce platform; Google and the Internet search engine algorithm; Facebook and the social media ecosystem; Microsoft and the Windows operating system).

Steve Jobs had distinct personality traits. He was shy, but people often perceived him to be brash. Also, Jobs had the innate ability to make solid and instantaneous decisions. Sometimes these decisions might seem arbitrary to cause frustration to others. When Jobs said no to a multitude of product prototypes, that decision was almost always final. Jobs fixated on finding the next great product for his customers. His strategy placed lesser focus on monetization or product market dominance. At Apple, NeXT, and Pixar, Steve Jobs served as a product pioneer, a design thinker, and a transformational leader. At Apple University, Yale management professor Joel Podolny led the charge to teach the *Steve Jobs way*. The Jobs management legacy meant team accountability, simplicity, secrecy, and perfectionism.

Does leadership depend on innate ability or practical experience?

As Steve Jobs would say, leadership cannot come from innate ability and intuition; rather, leadership arises from core years of practical experience in pulling together conscious efforts to solve problems. Leadership skills cannot come from academic degrees and qualifications. Instead, leadership skills arise from individual beliefs, visions, and personal commitments. Each corporate vision should focus on user experience with better stakeholder value maximization. Effective business leaders communicate a cogent corporate vision to all employees so that these employees embrace this unique vision as their lifetime passion and love of work.

A major Jobs management legacy concerns the lean startup meme. Each tech firm should operate as a unique combination of lean startup companies that emphasize innovative entrepreneurship. Each solo startup can make continual improvements through positive feedback loops and iterative sequences. Each iteration enhances some inventive elements and features for better customer experience. All the solo startups serve as standalone product development groups that take responsibility for specific aspects of the company. Sometimes this lean startup culture of iterative feature enhancements leads to landmark business innovations that can disrupt the entire tech industry (e.g. Apple iPhones, iPads, iPods, and iTunes).

Further, Apple serves as a customer-service organization with user-friendly smart products, mobile devices, and media services such as music, audio, and video etc. Apple senior leadership follows the timeless business principles and values such as empathy, positive social contribution, product quality, camaraderie, collegiality, team spirit, individual performance, innovation, and great management. Corporate value indoctrination begins as soon as new hires enter Apple.

Actions speak louder than words.

In the Jobs business model, senior leaders should encourage people to translate goals and visions into actionable insights. Key team leaders and project managers often must handle day-to-day operations to provide advisory guidelines for senior executive heads. These middle managers must learn to trade off efficiency gains and rewards with potential risks. In this fashion, these middle managers serve as *intrapreneurs* who can promote product design and development for better user experience within Apple.

Key recruitment decisions are as important as product design and development. Jobs would argue against pushing people to fall in line as in the Navy. Alternatively, the Jobs business model emphasizes a unique culture of pirates who wish to follow their own rules and ethics. For this reason, it is important for senior leaders to find extraordinary people with fresh talents, technical skills, prescient insights, as well as clairvoyant mindsets. In each lean startup, the first 5 to 7 key people would often determine whether the lean startup succeeds in business practice. In light of these considerations, senior leaders cannot be rigid about core recruitment requirements. Also, the recruitment process should involve many team members to help ensure that the ideal job candidate lands on the same wavelength. As Steve Jobs would suggest, recruitment should move beyond the usual methods.

It is important for senior team leaders to use casual conversations, interviews, and technical details to ferret out the genuine intentions and potential contributions of each job candidate well beyond what looks good on paper. Each candidate should present his or her own valid thoughts, ideas, views, opinions, and sometimes even predictions. These qualitative perspectives should help inform business decisions in the broad context of real-world problems. It is important for senior team leaders to ensure that each candidate is brave and confident enough to deliver bad news (or even inconvenient truths). All of these considerations help senior team leaders determine what type of person would best fit each role.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) © 2013-2023

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2017-04-07 15:34:00 Friday ET

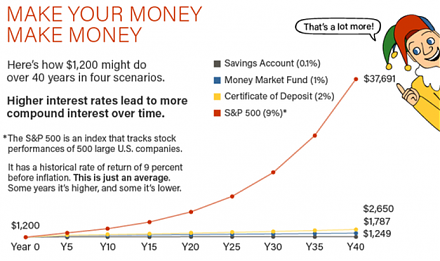

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr