2018-11-19 09:38:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Google from the European Union makes him consider pursuing fresh rules and regulations on Amazon, Facebook, and Google.

There is a pervasive concern that these tech titans monopolize specific niches with both exorbitant market power and dominance. Amazon dominates in e-commerce and cloud service with substantial clout; Facebook specializes in social media with more than 2 billion active users; and Google monopolizes online search with 90%+ U.S. Internet search traffic. The tech titans seek to make productive use of artificial intelligence to expand into the adjacent markets for autonomous vehicles, smart home appliances, and many other mobile devices. For these relevant reasons, the Trump administration considers antitrust actions against these tech giants.

The Trump administration may impose one-off penalties on Amazon, Facebook, and Google etc for specific antitrust situations. However, President Trump has no comment on breaking up the tech titans. The prior Microsoft case can offer insights into this similar antitrust dilemma, and the Trump administration may further draw lessons from the rules and regulations on banks and pharmaceutical firms.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-10-13 16:22:00 Sunday ET

Apple unveils 3 iPhone 11 models with new original video services and stars such as Oprah Winfrey, Jennifer Aniston, and Reese Witherspoon. Apple releases t

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr

2018-01-23 06:38:00 Tuesday ET

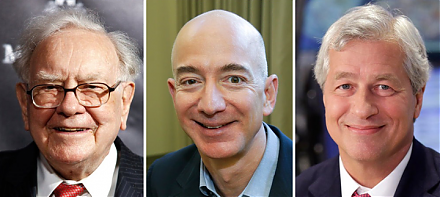

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2017-08-01 09:40:00 Tuesday ET

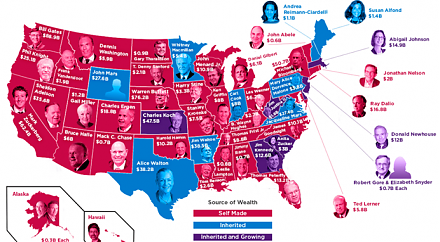

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2018-03-02 12:34:00 Friday ET

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariff

2018-05-11 09:37:00 Friday ET

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2