2019-06-15 10:28:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Sino-American trade war may slash global GDP by $600 billion. If the Trump administration imposes tariffs on all the Chinese imports and China retaliates with countermeasures, the global stock market may decline by 10%. In this worst-case scenario, Bloomberg expects global GDP to fall 0.6% or $600 billion by mid-2021. The same simulation suggests that both U.S. and Chinese economic output may decline by 0.7% to 1%. Several countries such as Canada and Europe rely heavily on Sino-American trade and so may suffer as a result. In terms of better balancing the bilateral trade deficit, this deficit has indeed declined from $91 billion to $80 billion from 2018Q1 to 2019Q1 (as the Trump tariffs come into effect). Further, the current U.S. CPI inflation hovers in the range of 1.6% to 1.9% (still below the 2% target level). This fact thus defies the Chinese allegation that the Trump tariffs may substantially raise the Chinese import prices with substantial inflationary pressure.

U.S. retail sales growth continues to slow down even though American consumer confidence rebounds in early-2019 due to higher wages and inelastic labor market conditions. The recent 8% renminbi devaluation coincides with the 25% Chinese stock market plunge and less foreign direct investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2017-10-21 08:45:00 Saturday ET

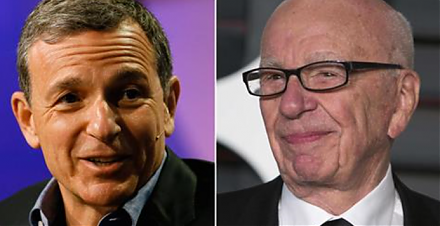

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2019-06-07 04:02:05 Friday ET

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutic

2017-02-25 06:44:00 Saturday ET

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces*