2019-06-15 10:28:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

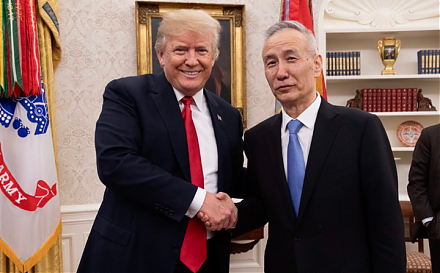

The Sino-American trade war may slash global GDP by $600 billion. If the Trump administration imposes tariffs on all the Chinese imports and China retaliates with countermeasures, the global stock market may decline by 10%. In this worst-case scenario, Bloomberg expects global GDP to fall 0.6% or $600 billion by mid-2021. The same simulation suggests that both U.S. and Chinese economic output may decline by 0.7% to 1%. Several countries such as Canada and Europe rely heavily on Sino-American trade and so may suffer as a result. In terms of better balancing the bilateral trade deficit, this deficit has indeed declined from $91 billion to $80 billion from 2018Q1 to 2019Q1 (as the Trump tariffs come into effect). Further, the current U.S. CPI inflation hovers in the range of 1.6% to 1.9% (still below the 2% target level). This fact thus defies the Chinese allegation that the Trump tariffs may substantially raise the Chinese import prices with substantial inflationary pressure.

U.S. retail sales growth continues to slow down even though American consumer confidence rebounds in early-2019 due to higher wages and inelastic labor market conditions. The recent 8% renminbi devaluation coincides with the 25% Chinese stock market plunge and less foreign direct investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2019-11-21 11:34:00 Thursday ET

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. ec

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2019-08-20 07:33:00 Tuesday ET

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minis

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form