2019-01-10 17:31:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would become an oncology powerhouse with $8 billion blockbuster medications. Celgene share price surges 21% as Bristol-Myers Squibb (BMS) announces this acquisition. When the deal closes, Celgene shareholders would receive one BMS share, $50 in cash for each Celgene share, and one tradeable contingent value right for each share of Celgene. This contingent value right entitles its holder to gain a one-time potential payment of $9 in cash upon FDA approval of all 3 main medications of ozanimod (31 December 2020), liso-cel (31 December 2020) and bb2121 (31 March 2021).

BMS already owns a rich portfolio of blockbuster medications. These medications include the top-selling PD-1 checkpoint inhibitor Opdivo, the leukemia drug Sprycel, the melanoma drug Yervoy, the multiple-myeloma drugs Revlimid and Pomalyst, and the pancreatic cancer medicine Abraxane. These medications generate about $5.9 billion revenue in 2018Q3. These landmark medications position BMS as the market-share leader in immune-oncology and hematology.

The BMS specialty market niche and patent portfolio collectively create competitive moats for the new biopharma goliath in comparison to Johnson & Johnson, Merck, Pfizer, Roche, and Novartis etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-09 12:43:00 Saturday ET

Pinterest files a $12 billion IPO due in mid-2019. This tech unicorn allows users to pin-and-browse images through its social media app and website. Pintere

2018-03-05 07:34:00 Monday ET

Peter Thiel shares his money views of President Trump, Facebook, Bitcoin, global finance, and trade etc. As an early technology adopter, Thiel invests in Fa

2017-10-21 08:45:00 Saturday ET

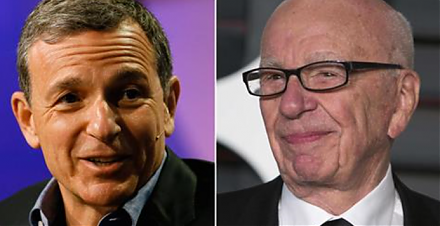

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv