2019-01-10 17:31:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would become an oncology powerhouse with $8 billion blockbuster medications. Celgene share price surges 21% as Bristol-Myers Squibb (BMS) announces this acquisition. When the deal closes, Celgene shareholders would receive one BMS share, $50 in cash for each Celgene share, and one tradeable contingent value right for each share of Celgene. This contingent value right entitles its holder to gain a one-time potential payment of $9 in cash upon FDA approval of all 3 main medications of ozanimod (31 December 2020), liso-cel (31 December 2020) and bb2121 (31 March 2021).

BMS already owns a rich portfolio of blockbuster medications. These medications include the top-selling PD-1 checkpoint inhibitor Opdivo, the leukemia drug Sprycel, the melanoma drug Yervoy, the multiple-myeloma drugs Revlimid and Pomalyst, and the pancreatic cancer medicine Abraxane. These medications generate about $5.9 billion revenue in 2018Q3. These landmark medications position BMS as the market-share leader in immune-oncology and hematology.

The BMS specialty market niche and patent portfolio collectively create competitive moats for the new biopharma goliath in comparison to Johnson & Johnson, Merck, Pfizer, Roche, and Novartis etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2018-01-04 07:36:00 Thursday ET

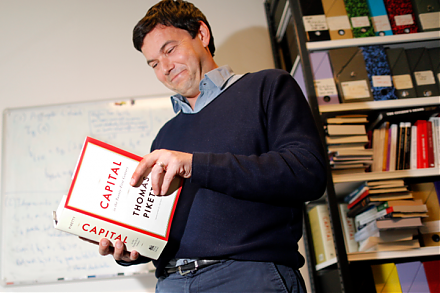

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2019-11-05 07:41:00 Tuesday ET

The Trump administration expects to reach an interim partial trade deal with China. This interim partial trade deal represents the first phase of a comprehe

2020-05-07 08:26:00 Thursday ET

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod