2019-08-02 17:39:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Phillips curve becomes the Phillips cloud with no inexorable trade-off between inflation and unemployment. Stanford finance professor John Cochrane disagrees with Harvard macro economist Gregory Mankiw with respect to the mysterious and inexorable trade-off between inflation and unemployment. It is difficult to depict a key downward Phillips curve for the post-war period because there is no conclusive trade-off between inflation and unemployment. This empirical result remains true even when we consider alternative measures of U.S. inflation such as the deflator for personal consumption expenditures (PCE) and core consumer price index (CPI) inflation less food and energy. Furthermore, the empirical result continues to hold in practice when we consider the economic output gap in lieu of the unemployment rate. Cochrane suggests no clear trade-off between inflation and unemployment in the Phillips cloud. In other words, the Phillips curve is too flat to be true.

This analysis poses a conceptual challenge to New Keynesians who seek to attain the Federal Reserve dual mandate of both price stability and maximum sustainable employment. The central bank can constrain money supply growth as a potential source of economic disturbance; yet, the long-term welfare cost of low inflation has no real impact on economic output, employment, and capital investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-02 12:34:00 Friday ET

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariff

2020-05-07 08:26:00 Thursday ET

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,

2017-11-13 07:42:00 Monday ET

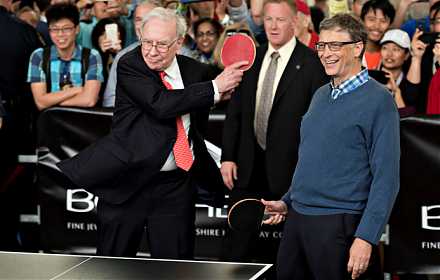

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins

2018-08-15 14:40:00 Wednesday ET

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She

2016-10-01 00:00:00 Saturday ET

We can learn much from the frugal habits and lifestyles of several billionaires on earth. Warren Buffett, Chairman and CEO of Berkshire Hathaway, still l