2018-10-09 08:40:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The International Monetary Fund (IMF) appoints Harvard professor Gita Gopinath as its chief economist. Gopinath follows her PhD advisor and trailblazer Kenneth Rogoff (who served as a former chief economist at the IMF) and Ben Bernanke (who served as the chairman of the U.S. Federal Reserve in response to the global financial crisis from 2008 onwards).

This appointment puts another pillar of mainstream orthodoxy about the benefits of flexible exchange rates on notice. This transition aligns with the IMF advocacy of the Washington consensus that constitutes economic policies in favor of free cross-border capital transfer and fiscal consolidation. With flexible exchange rates, an open economy can better cushion against external shocks and transitional price gyrations. A country whose currency depreciates against the global trade dollar index should observe more competitive export prices relative to import prices. As the country faces a decline in the terms of trade, foreigners face an inherent price incentive to buy more export goods and services from this country. Thus, this trend helps reinvigorate the open economy via its current account channel.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2020-03-26 10:31:00 Thursday ET

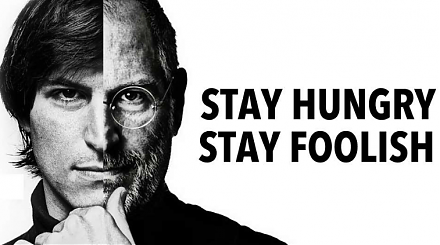

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2019-04-15 08:37:00 Monday ET

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Be

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis