2018-10-09 08:40:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The International Monetary Fund (IMF) appoints Harvard professor Gita Gopinath as its chief economist. Gopinath follows her PhD advisor and trailblazer Kenneth Rogoff (who served as a former chief economist at the IMF) and Ben Bernanke (who served as the chairman of the U.S. Federal Reserve in response to the global financial crisis from 2008 onwards).

This appointment puts another pillar of mainstream orthodoxy about the benefits of flexible exchange rates on notice. This transition aligns with the IMF advocacy of the Washington consensus that constitutes economic policies in favor of free cross-border capital transfer and fiscal consolidation. With flexible exchange rates, an open economy can better cushion against external shocks and transitional price gyrations. A country whose currency depreciates against the global trade dollar index should observe more competitive export prices relative to import prices. As the country faces a decline in the terms of trade, foreigners face an inherent price incentive to buy more export goods and services from this country. Thus, this trend helps reinvigorate the open economy via its current account channel.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

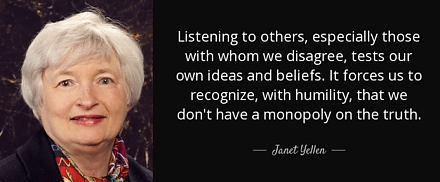

2017-12-11 08:42:00 Monday ET

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to t

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2018-05-15 08:40:00 Tuesday ET

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the