2022-08-30 10:32:00 Tue ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm central bank cbdc

As long as banks have existed in human history, their managers have realized how not all depositors demand their money back at once in normal times. These banks do not have to keep cash on hand for every deposit. Instead, these banks can use the money to make loans for better macro credit expansion. In a fundamental way, banks provide funds for private capital investments and so earn net interest income for themselves. The fractional reserves that banks hold against their deposits have another effect. In practice, these fractional reserves make banks unstable financial institutions. The human history of monetary capitalism reflects relentless economic enrichment with the scars of both frequent bank runs and financial crises.

Technological advances settle and process almost all payments through the digital transmission mechanism. Most banks are far bigger. The total assets of the biggest 1,000 banks worldwide are worth at least $128 trillion in 2020-2022. This valuation dwarfs the annual global GDP of about $85 trillion.

However, a world without banks is visible on the horizon. Their role is under threat from new technology and even the public sector. Tech giants such as Meta, Apple, Microsoft, Google, Amazon, PayPal, Alibaba, and Tencent etc develop quicker and easier online payment systems that can pull transactions out of the banking system. Digital payments may bring about the end of cash. Both financial regulation and monetary policy have traditionally operated through banks. If this usual monetary transmission mechanism is lost, central bank regulators may have to create digital money instead.

In our modern capitalist society, we cannot explain most economic actions with no account of money. Almost all economic propositions are practically relative to the modus operandi of a given monetary system. Nonetheless, it is possible for us to see a future where most banks play a much smaller role. Central banks can come up with digital money, and tech firms and capital markets settle and process many deposits and financial transactions via online payment platforms.

With the alchemy of global finance, banks turn idle deposits into economic engines for capital investments worldwide. In each of the OECD countries, only 3 to 4 banks dominate as national champions. Both state-driven digital currencies and private payment platforms can benefit from pervasive network effects. The power tends to concentrate in only 1 to 2 state institutions (i.e. the central bank and fiscal treasury). The state can further use digital money for better social control. From time to time, cash is not traceable, but digital money leaves a trail. The state can try to program exclusively digital money to restrict its use. In this positive light, the state can make fiscal stimulus programs more effective to target specific groups. With macro credit provision, the state plays a crucial role for better social control. On the other hand, the current fintech trend may lead to the concentration of power in tech titans and governments. A world without banks may sound like a dream. This dream may turn out to be more like a nightmare.

Modern financial institutions are the interface between investors and their capital. Gains and losses flow back to these investors. By investing capital this way, people typically deploy their own money, and their funds act only as an intermediate tool. Banks use deposits (i.e. the money of others) to extend loans. But bank customers expect to get their deposits back in full. These customers do not expect to bear the bank’s loan losses in bad years. Neither do these customers expect to reap greater rewards in good years.

This process may make banks unstable, but this process also gives banks a major advantage in financial services because deposits and loans are complementary in due course. As a result, banks have become the providers of any and all financial services from credit cards and mortgages to stock investment recommendations. The clout of non-bank financial firms grows in the meantime. This growth renders bank balance sheets less valuable in macro credit expansion. Further, tech titans such as Meta, Apple, Microsoft, Google, and Amazon (FAMGA) etc now use their power of online payment platforms to muscle into the main business niche for most traditional banks.

Non-U.S. tech giants include Alibaba and Tencent in China, Grab and Gojek ride-share services in Singapore and Indonesia, and Mercado Pago (the financial arm of MercadoLibre) e-commerce in Latin America. Their model of financial services starts by serving as a dominant service provider that customers use daily. In China, specifically, AliPay and WeChat Pay initially act as escrow accounts for customers to transfer money to sellers after buyers have received their goods or services via these mobile apps. Nowadays each shop owner only needs to display the QR code to accept mobile payments. As of early-2022, AliPay and WeChat Pay each attract more than 1.2 billion active users in China. In particular, AliPay handles more than $16 trillion in online payments each year in 2020-2022, nearly 25 times more than PayPal, the biggest online payment platform in America. Now AliPay and WeChat Pay settle and process more than 90% of mobile transactions in China.

Both tech giants earn as little as 0.1% of each transaction, less than banks do from debit cards. Around the world, mobile interchange fees have dramatically tumbled because of these tech firms. Online payment platforms may become a gateway for allowing tech titans to attract more active users worldwide. Using online payment data, Alibaba, Grab, and Tencent etc can determine borrower creditworthiness. In practice, this consumer credit assessment contributes to the internal mechanism for approving credit cards, mortgage loans, and small business retail loans etc.

Banks use many traditional ways such as credit history, current wealth, and income documentation etc to assess borrower creditworthiness. These banks then secure loans against collateral such as homes and cars to minimize the essential need to monitor each borrower. For many tech titans, online payment data can substitute for collateral. Online payment platforms collect a ton of information about borrower creditworthiness. This consumer reliance represents an inverse of the information asymmetry such that lenders know more about whether borrowers can repay loans (than borrowers themselves). Big tech and fintech firms have lent $450 per capita or around 2% of total credit in China from 2018 to 2022.

There are substantial synergies between loans and many other financial products and services such as asset management and insurance. Tech titans now use their online payment platforms to reverse-engineer most banking products and services. In America, credit card sweeteners attract and retain active users worldwide. For instance, PayPal provides the one-stop conglomeration of financial services from bank deposits and wire transfers to credit cards, mortgages, small business loans, insurance policies, and even stock market investment recommendations. PayPal has almost doubled in market value in 2020-2022 and serves as the most valuable online payment platform in the world. Another business payment provider, Stripe, now hits the market value of about $95 billion and thus serves as one of the largest private tech companies in America. Stripe offers both retail and wholesale banking services to small-to-medium-size enterprises (SMEs). Stripe wins favor with SMEs by making it easier to embed online payments in their respective websites. Further, Stripe has expanded into corporate payroll and cash management services.

These fintech payment platforms cannot possibly offer all banking services simply because these platforms lack bank deposits to sustain perpetual credit expansion. Each bank keeps its own fortress balance sheet with secure deposit funds to make loans for creditworthy customers. The main bank advantage relates to the domain knowledge in both credit risk assessment and customer relationship management. In stark contrast, the main fintech advantage relates to the fact that tech titans can still lend to creditworthy borrowers even though these tech titans lack bank deposit funds for macro credit expansion. These fintech platforms may or may not exercise due diligence with credit risk domain knowledge in their private credit provision. In practice, whether these platforms can sustain their credit expansion remains open to controversy.

Most tech titans have chosen to opt against key bank licenses. Instead, these tech titans prefer to skim the cream off the top. The traditional capital-intensive activity of banks makes $3 trillion in revenue worldwide with a 5% to 6% return on equity (ROE). Most fintech payment platforms yield $2.5 trillion in revenue worldwide with a 20% to 25% ROE. This comparison may or may not be sustainable in the longer run. One day, central banks and other financial regulators may subject fintech firms to stringent core bank capital requirements, disclosure standards, and other Dodd-Frank rules and regulations such as macro stress tests and dividend restrictions.

Banks still hold their dominant position in credit loan origination. Non-bank financial institutions hold 35% of all U.S. credit assets such as loans and securities. In fact, the latter seems to grow a lot faster than the former. In 2020-2022, non-bank credit assets grow by almost 9%, whereas, bank credit assets grow by only 4.5%. Banks remain the largest source of specific loans. As of early-2022, banks still hold about 85% of global credit assets. This bank switch is most apparent in America, Britain, Canada, and Europe.

Most non-OECD countries are very bank-dependent with nascent capital markets. Some of their capital markets are still in their infancy. The recent rise of both tech titans and capital markets is therefore good news worldwide. Most non-bank tech titans cannot undertake the maturity and liquidity transformation that makes banks vulnerable to runs. The recent triumph of these alternative competitors brings clear benefits but also some risks. There are substantial scale economies for both banks and tech titans. Big banks spread the costs of branches over many customers. The value proposition for each customer to join a bank scales with size. Each bank can offer cheaper products and services because the bank has lots of customers. Yet, the value proposition for each payment platform grows exponentially with the size of the user network as each new user makes the whole platform more valuable.

Now the debate over tech monopolists focuses on the interoperability of user data. If online behaviors reveal useful information about whether each customer qualifies for a loan, this information would be more useful if all the potential financial service providers can access core borrower data. Sharing credit data may help open most traditional banking services to non-bank tech titans and capital markets. However, tech titans may inadvertently exploit their market dominance to create silos of user money within their respective online payment platforms. Financial regulators such as the Federal Reserve System and Treasury would have to address this concern in time. In response to the Global Financial Crisis (GFC) of 2008-2009, the Federal Reserve System intervenes in capital markets, and goes to much greater lengths to prop up commercial and investment banks. Rather than acting as the lender of last resort only to banks, the Federal Reserve System becomes the market-maker of last resort. The Federal Reserve System can intervene directly in credit markets with quantitative easing (QE) large-scale asset purchases. The total scale of these asset purchases hits $23.5 trillion and thus surpasses any other rescue programs in the long prevalent history of the Federal Reserve System. These macro-financial stabilization efforts make it harder for the U.S. government to avoid picking winners from banks and non-bank tech titans and capital markets. As the world changes to be more inclusive with new tech monopolists, the regulatory toolkit has to adapt to the mega trend of greater financial inclusion.

Firm used to invest in tangible capital such as machines, railroads, and vehicles to manufacture products. Now firms increasingly invest in intangible capital such as research, software, and brand design to produce intellectual property. Almost 13% to 15% of the business output back in the 1980s was spent on tangible assets and only 9% on intangible assets. By mid-2022, these shares had switched. About 15% was spent on intangible assets and only 9% on tangible assets.

The recent rise of intangible assets may explain several capital market trends. Now private firms tend to stay private for longer, and public corporations often buy out smaller private target firms through mergers and acquisitions. Software companies can find it easier to protect intellectual property in private markets. Rigid accounting rules do not cope well with intangible capital, for instance, by booking expenditures on research and development as an R&D expense in a given fiscal year.

This structural shift has other broad implications. Lenders like collateral. Whenever financiers make loans, these lenders worry about getting both principal and interest repayments, but these lenders can take valuable property in case of default. Most consumer loans rest on the secure collateral assets such as cars and houses. But businesses that create intangible assets often do not have such collateral. Debt is often not available for new businesses with lots of intangible assets at a reasonable rate. Nowadays many small tech unicorns seek cash funds from venture capitalists and large corporations through special purpose acquisition companies (SPAC) (or simple cash mergers and acquisitions).

U.S. software companies hold debt worth 10% of equity. By contrast, restaurants often hold debt worth 90% of their equity. Tech firms frequently rely on seed equity and venture capital. If these smaller tech firms with lots of intangible assets attract debt to boost market value without having to raise equity, these tech firms can limit a significant amount of dilution. This capital structure feature can be very valuable for founders, early investors, and senior managers.

For software companies specifically, their intellectual property and human capital accumulation can help generate revenue from code. Their founders are willing to take risks and losses when the minimum viable product (MVP) once had value but the industry was so disruptive that the MVP no longer has value. In this case, those founders would lead iterative continuous improvements for the dual transformation of software as a service (SaaS). This dual transformation secures sustainable cash flows from software assets, and then molds iterative continuous improvements for the MVP to become the new generation of software products and services. These disruptive innovations are feasible within smaller tech unicorns and online payment platforms. However, big banks are less flexible to undertake these disruptive steps. With lots of intangible assets, tech unicorns can sustain niche business operations in processing online payments, stock market investment signals, analytic reports, and personal finance tools.

Banks should now learn to survive the transition to a new global monetary system with intangible assets and digital currencies. Central bank digital currencies (CBDC) are a digital version of cash made and issued by central banks. In most countries, the tech design of CBDCs resembles the current online payment platforms with a major difference: money as a CBDC is equivalent to a deposit with the central bank. If traditional cash can no longer be as useful as CBDCs for day-to-day transactions, traditional cash loses much potency (as a medium of exchange or a store of value).

It is still a radical intervention for many central banks to issue CBDCs. CBDCs can threaten the traditional banking system. The ultimate displacement of bank loans may inadvertently undermine macro credit expansion. For almost 200 years, most monetary systems have relied on the framework of lender-of-last-resort in the form of a government body that can intervene to save solvent financial institutions. The modern iteration of a lender of last resort is an independent central bank such as the Federal Reserve System and European Central Bank. The central bank offers money both in cash and by creating bank reserves (i.e. cash deposits against bank loans).

The private bits of the monetary system are the banks. These banks offer financial services by collecting deposits and making loans. By holding only some fraction of these deposits and lending the rest, banks can create money through this financial intermediation. The original deposits remain ready to be called on in full, but there are now new deposits from the principal and interest proceeds of the loans. All of the deposits can be used as money to make payments. In America, the quantity of broad money has remained the same as a share of GDP for 100 years. Some 90% of broad money is in private bank deposits. In other economies, the share of broad money is higher: 91% in Europe, 93% in Japan, and 97% in Britain. Because bank loans are long-term illiquid assets, whereas, deposits are short-term liquid liabilities, banks need the central bank as a lender of last resort in a financial crisis. As banks take on greater risks by making more loans, these banks face moral hazard in due course. In order to curb this moral hazard, financial regulators need to undertake prudential oversight of banks through on-site exams and macro stress tests.

Central bank wallet apps may not sound revolutionary. However, the basic idea of a central bank providing digital money directly to citizens is quite radical. If citizens can convert bank deposits into central bank money with a simple swipe, the CBDC technology can potentially accelerate bank runs. This CBDC technology may help pull deposits out of the banking system onto the central bank’s balance sheet. In effect, this inadvertent consequence may lead to bank disintermediation.

Banks should be able to hold sufficient liquid assets to back all their deposits. Bank deposits are worth almost $17 trillion in America. Banks hold more cash reserves with the Federal Reserve System with an excess of more than $3 trillion. In practice, the Federal Reserve System should nationalize CBDCs but not banking services. Through the global history of central bank money, it is difficult for the government to stick to a commitment of restraint. In monetary policy, the central bank needs to convey credible future interest rate trajectories in order to shape the capital market expectations of both output and inflation. In prudential oversight, the central bank has to communicate credible macro stress test scenarios and capital requirements. Should the central bank curtail liquidity and maturity transformation, the resultant bank disintermediation would trigger collateral damage to economic growth. With various haircuts, the central bank should serve as a pawnbroker for all seasons to lend to anyone who can supply collateral.

In the political economy of the money and credit architecture worldwide, there is a choice of banks with fractional reserves. The global society voluntarily chooses the current financial stability problem with prudential oversight. This choice keeps the government out of macro credit expansion. In accordance with the Chicago school of economic thought, this choice reflects minimal state intervention in our capitalist society. We need greater central bank intervention in CBDC credit allocation. The biggest problems with CBDCs include bank disintermediation, privacy protection, and currency substitution across borders. U.S. regulators would need buy-in from Congress, the Biden administration, and broader elements of the public. A new era of central bank money would require public approval.

The American dollar is quite pervasive because everyone uses the greenback as the common unit of account. Most multinational corporations trade goods, services, and natural resources such as oil and natural gas in dollars. Cross-border financial contracts are written in dollars. Global travelers keep $100 bills in their briefcases. Financial markets and trade contracts have grown faster than the global economy for decades, so the American dollar has been ever more dominant. This rare dollar dominance gives the U.S. significant clout that the government exploits through its use of economic sanctions on Russia in its recent invasion of Ukraine.

A first reason for a digital currency relates to the protection of monetary sovereignty. Each central bank can issue its own digital currency with no adverse effect on the dual mandate of both price stability and maximum employment in another country. There are at least 2 possible rationales for the government to intervene in this way. First, tech titans should not monopolize online payment data, and any data usage should be subject to surveillance by the fiscal treasury. Second, the central bank may maintain capital controls in order to preserve monetary policy independence in the flexible exchange rate regime in the context of the Mundell-Fleming trilemma. Here government intervention helps with better fiscal-monetary policy coordination in each open economy.

A second reason for a digital currency relates to what happens when several other currencies become digital. If China fails to establish its own digital currency in time, for instance, global trade and finance would flow into dollars and euros. In many parts of the world, the central bank must better manage the risk of foreign currency competition. Further, the central bank cannot afford to lose monetary autonomy at the expense of high inflation (or even stagflation or high inflation and low economic growth).

The transition from traditional banking services may make financial services fairer and cheaper, but this transition may inadvertently threaten monetary sovereignty and privacy. As capital markets expand, it has become easier for online payment platforms to match assets and liabilities. This mega trend reduces the risk of bank runs. Instead of liquid assets, fintech payment platforms use online data to secure loans. People and businesses can now borrow money against their character but not their collateral.

In financial services, this quiet revolution causes new problems. Because payment platforms benefit from network effects, these platforms tend to concentrate into just 2 to 3 giant intermediaries. As several financial services migrate away from banks, the extant monetary transmission mechanism may become obsolete. Around the world, many central banks try to accelerate fast payment systems with new digital currencies. As people move their money into CBDCs, these people can pull money out of banks. In a negative light, this transition threatens the traditional system for bank loans with no or minimal overt state interference in credit allocation. Malicious actors may destabilize cross-border payment systems through cyber warfare.

The best defense against state influence over bank loans is to keep alive the extant system of fractional reserves. This transition may entail constraining the scope of CBDCs. Further, this transition may require managing CBDCs at arm’s length from the central bank. When push comes to shove, the law of inadvertent consequences counsels caution.

The Federal Reserve System seems a bit behind the curve. Inflation is now 5% to 9% or well above the 2% average inflation target in both CPI and PCE terms. The U.S. unemployment rate is 4% or well below the congressional budget estimate of full employment. In this macro environment, interest rates should be a little above neutral (above 2% to 3%). For this reason, the Federal Reserve System has a lot of room to catch up. In this light, the Federal Reserve System should have pivoted earlier toward 50-basis-point to 75-basis-point interest rate hikes.

U.S. monetary policymakers worry about throwing the economy into a recession, especially given the recent geopolitical developments such as the Russia-Ukraine war and ongoing pandemic crisis. The Federal Reserve System is likely to remain relatively cautious to continue rate hikes in accordance with the average inflation target (AIT) framework. U.S. monetary policymakers now seek to achieve inflation near the 2% average target without disrupting too much the labor market. The labor market looks much tighter, especially in light of the current gap between available jobs and workers. This measure compares the total number of all available jobs to the number of workers in the labor force. In effect, this measure has been a strong predictor of wage growth in the last few decades. Today, jobs outnumber workers by the largest margin since the end of World War II. Despite a shortfall of 2.2 million jobs relative to the pre-pandemic level, there are still not enough workers to fill the open positions today. This impasse raises the risk of a wage-price spiral. Thus, the Federal Reserve System needs to accelerate interest rate hikes in 50-basis-point to 75-basis-point increments. This acceleration helps better align the stock market expectations of output, inflation, and the interest rate.

Interest rate hikes cannot boost aggregate supply, but the current problem is that aggregate demand is much greater than aggregate supply. Greater rate hikes can help reduce aggregate demand as fewer people buy homes, cars, and other goods and services. In time, these interest rate hikes help contain inflation in accordance with the Federal Reserve AIT monetary policy framework.

Federal Reserve balance sheet management plays an important role. Targeting long-term rates through the balance sheet (instead of short-term rates through the Fed funds rate) may be more effective in containing inflation over the medium term. As financial intermediaries borrow at the short end and lend at the long end, rapid increases in short-term interest rates flatten the Treasury yield curve. The resultant yield curve reduces the incentive for financial intermediaries to extend credit. As a consequence, low-to-medium-income borrowers are likely to suffer less access to credit.

A reasonable baseline is that the Federal Reserve System begins balance sheet shrinkage in 2022H2-2023. In this baseline scenario, the Federal Reserve System lets Treasury bonds and mortgage securities run off with the respective maximum caps of $60 billion and $40 billion per month. The Fed balance sheet should shrink by $2.5 trillion to $3 trillion over the next 3 years from 2022 to 2025.

Asset markets price the probabilities of a reasonable range of scenarios instead of a single path. How much higher is the terminal interest rate likely to be? Addressing this question depends on how hard it is for the Federal Reserve System to contain inflation. Some other factors come into play too. These factors include fiscal policy programs, global stock market developments, geopolitical risks, and novel corona virus variants. If it takes longer for inflation to come down to the 2% average target, nominal interest rates would need to be high enough to slow inflation and economic growth. In accordance with the baseline scenario of Fed balance sheet shrinkage, the terminal interest rate is likely to land in the reasonable range of 3% to 5% from 2022 to 2025.

Our March 2023 forecasts for 2-year and 10-year Treasury bond yields are 2.25%-2.50% and 3%-3.25% respectively. Some further Treasury bond selloff is likely to take place in the next few quarters. The Russia-Ukraine military conflict has led to substantial volatility in Treasury bond yields, and the adverse impact of this conflict on U.S. economic growth is likely to be minimal. However, the energy implications may inadvertently boost inflation in both CPI and PCE terms due to oil and natural gas price hikes. We continue to expect directionally higher Treasury bond yields in 2022-2025. The medium-term stock market expectations for the terminal rate of 3.5% to 5% look quite reasonable.

Treasury yield curve inversion has historically been significantly indicative of each U.S. recession since the 1970s. The stock market now prices in interest rate hikes of 50-basis-point to 75-basis-point increments. In light of the geopolitical risks such as the Russia-Ukraine war and the new pandemic crisis, we expect relatively low odds of this monetary policy cycle tipping the U.S. economy into a mild recession. In the meantime, the current stock market expectations seem to underestimate the terminal rate around 2.5% to 3% (well below our reasonable range of 3.5% to 5%). Many investors believe that the monetary policy normalization cycle seems shallow. In this view, the Federal Reserve System would not need to increase interest rates substantially to bring 5% to 9% inflation back under control. However, we believe that the Fed funds rate would need to hike toward the terminal rate of 3.5% to 5% maybe in 50-basis-point to 75-basis-point increments. This alternative interest rate path better accords with the current stock market expectations of output, inflation, and the interest rate in the next few years.

We assess the alternative U.S. bond market conundrum: long-end Treasury yields are sticky, even as front-end yields seem to have risen in due course, due to the global duration demand-supply imbalance. The imbalance tends to distort the price signals at longer maturities with lower real risk premiums. Despite high sovereign debt issuance, there is a global shortage of risk-free long-duration assets, as most G10 central banks have been buying these assets aggressively in recent years.

The neoclassic contractionary monetary policy cycle relies upon interest rate hikes. These rate hikes tend to flatten the Treasury yield curve as the front-end is almost arithmetically close to the Fed funds rate. In recent months, several Fed governors convey the concern that the Treasury yield curve now seems to flatten at low levels with some cloudy recessionary prospect. Balance sheet shrinkage cannot be some particularly fruitful way to deepen the yield curve. A reasonable baseline is that the Federal Reserve System begins balance sheet shrinkage in 2022H2-2023. In this baseline scenario, the Federal Reserve System lets Treasury bonds and mortgage securities run off with the respective maximum caps of $60 billion and $40 billion per month. The Fed balance sheet should shrink by $2.5 trillion to $3 trillion over the next 3 years from 2022 to 2025. If the Treasury leans heavily on bills instead of Treasury coupon bonds to replace lost Fed finance, investors would not have to absorb the significant amount of new duration risk. The Treasury bond price impact of balance sheet shrinkage would thus be small. At any rate, cautious Fed balance sheet management can help reduce the odds of monetary contraction tipping the economy into a moderate or even severe recession. The Federal Reserve System is most likely to synchronize monetary policy normalization (of interest rate hikes) with better yield curve control. In this positive light, we expect the next U.S. stock market recovery to accord with a steeper yield curve at subsequent junctures of the current monetary policy cycle. In practice, the Federal Reserve System would not intentionally cause the next U.S. recession with significant interest rate hikes.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

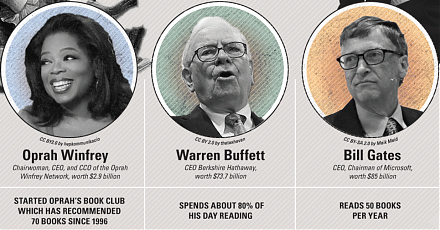

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2018-02-07 06:38:00 Wednesday ET

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with stro

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2025-01-22 08:35:08 Wednesday ET

President Donald Trump blames China for the long prevalent U.S. trade deficits and several other social and economic deficiencies. In recent years, Pres

2026-01-19 10:30:00 Monday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction