2018-05-03 07:34:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all-stock deal that exchanges 9.75 Sprint shares for each T-Mobile share. The bipartite company retains the T-Mobile name, keeps its CEO John Legere, and encompasses about 120 million subscribers. This merger carries about $146 billion enterprise valuation with debt in comparison to $313 billion Verizon enterprise value and $334 billion AT&T enterprise valuation. The latter telecom titans invest in substantial fiber-optic, wireless telecom, telephone, can cable television operations.

Joining forces would allow the company to build out a 5G wireless network in direct competition with AT&T and Verizon. This new merger clears the cloudy practices that may harm consumer benefits in the prior M&A attempt back in 2014. T-Mobile and Sprint suggest that times have changed a great deal since 2014 since several companies such as Comcast now enter the mobile business. Moreover, the White House advocates that 5G wireless communication technology is crucial for national economic security reasons. Many stock analysts now consider this mega merger to take place with a 50%+ chance of regulatory approval.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-31 08:42:00 Friday ET

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.

2018-07-30 11:36:00 Monday ET

Trumpism may now become the new populist world order of economic governance. Populist support contributes to Trump's 2016 presidential election victory

2018-05-09 08:31:00 Wednesday ET

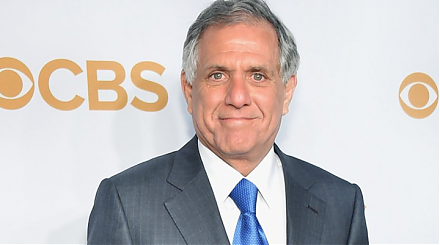

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-06-07 04:02:05 Friday ET

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutic

2019-08-10 21:44:00 Saturday ET

McKinsey Global Institute analyzes 315 U.S. cities and 3,000 counties in terms of how tech automation affects their workers in the next 5 to 10 years. This

2018-01-25 08:32:00 Thursday ET

After its flagship iPhone X launch, Apple reports its highest quarterly sales revenue over $80 billion in the tech titan's 41-year history. Apple expect