2017-03-03 05:39:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

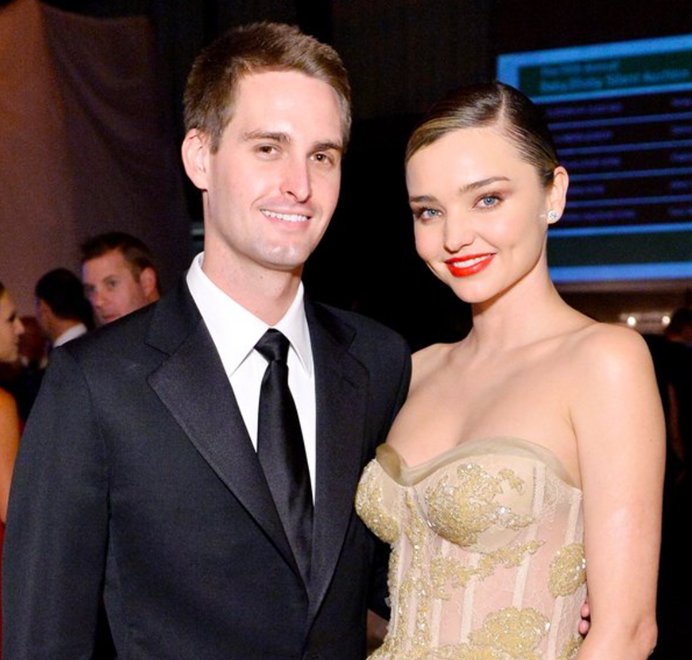

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

Having raised more than $3 billion from its IPO, Snap easily beats the bid price that Facebook offered back in 2013.

In this modern era of digital technology, many financial economists and market observers suggest that unicorns, or tech startups with $1 billion net worth, often seek to be packaged as profitable M&A targets for large public corporations.

Snap demystifies this unicorn puzzle by going public with its stellar stock market performance and millennial popularity.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2025-07-01 13:35:00 Tuesday ET

In recent times, financial deglobalization and asset market fragmentation can cause profound public policy implications for trade, finance, and technology w

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior