2019-08-28 14:46:00 Wed ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen finds that global interest rates persist at low thresholds in the current decade. In OECD and several other economies, low interest rates cannot bounce back too far from the zero lower bound during the global financial crisis.

In Europe, Japan, and Switzerland, the risk-free interest rates fall below zero. In this context, most central banks have little room for new interest rate reductions as the global economy gradually moves toward the next recession. In response to the current Sino-U.S. trade truce and Brexit economic uncertainty, Cohen proposes new countercyclical fiscal stimulus as a key alternative policy instrument for global economic revival. This new fiscal stimulus can manifest in the generic form of tax credits, transfer payments, and public expenditures in health care, infrastructure, education, and technology. Nevertheless, Cohen adds the cautionary caveat that lawmakers may remain reluctant to increase core fiscal deficits on top of post-crisis national debt mountains. To the extent that legislators become wary of backlash in parliamentary elections, it is important for politicians and technocrats to strike a better balance between democratic accountability and elite interest entrenchment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

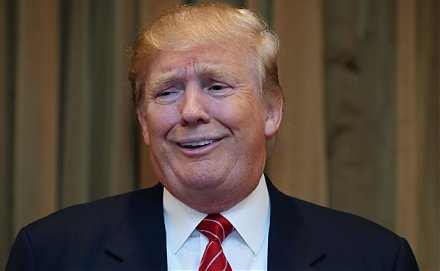

2016-11-08 00:00:00 Tuesday ET

Donald Trump defies the odds to become the new U.S. president. He wants to make America great again. He seeks to repeal Obamacare. He has zero tole

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2025-10-06 10:27:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-09-28 10:10:51 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind

2018-12-15 14:38:00 Saturday ET

Google CEO Sundar Pichai makes his debut testimony before Congress. The post-mid-term-election House Judiciary Committee bombards Pichai with key questions