2018-02-03 07:42:00 Sat ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Powell. This healthy fundamental recalibration indicates the recent fact that 96% of all S&P 500 stocks experience 20% drastic declines from their own 52-week high share prices. Key investor concerns relate to U.S. inflationary momentum and bond yield appreciation. As professional forecasters mull over the inexorable and mysterious trade-off between inflation and unemployment, the new Federal Reserve chairman tends to retain a hawkish monetary policy stance. These forecasters predict that the Federal Reserve may hike the interest rate at least 3 to 4 times this year. This neutral interest rate curtails U.S. inflation near full employment well within Powell's congressional dual mandate.

AQR money manager and founder Cliff Asness points out that the U.S. financial system remains robust with less leverage and fair valuation despite the recent stock market plunge in early-February 2018. Asness believes in his conservative implementation of quantitative fundamental strategies across the vast majority of his factor portfolios of stocks, bonds, commodities, and currencies.

His favorite value and momentum factor strategies resonate with Warren Buffett's long-term asset investment philosophy: *Price is what we pay, and value is what we get. We should be fearful when others are greedy, and we should be greedy when others are fearful.* In his recent letter to Berkshire Hathaway shareholders, Warren Buffett emphasizes that stock market corrections are often both normal and unpredictable. From a long-run perspective, the U.S. stock market sometimes goes *on sale*. Thus, Buffett suggests that it is important for investors to replenish their cash positions in order to take advantage of sporadic stock market corrections. When these corrections take place, the stock price often fall below the long-term equilibrium intrinsic value. Beyond conventional wisdom, greed is *good* and pays well in the tripartite form of capital gains, cash dividends, and share repurchases.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2023-07-21 10:30:00 Friday ET

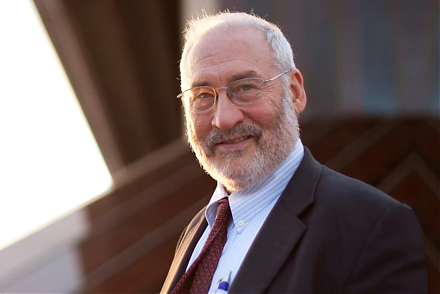

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2018-05-15 08:40:00 Tuesday ET

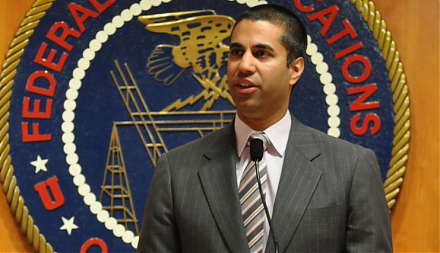

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies