2017-09-03 10:44:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Donald Trump has released his plan to slash income taxes for U.S. citizens and corporations. The corporate income tax rate will decline from 35% to 20%. The number of marginal income tax bands will be reduced to 3 at 12%, 25%, and 35%.

This tax overhaul represents a progressive pro-growth economic reform with better jobs, higher wages, and lower taxes for most American consumers, as well as lower risks, fewer financial constraints, and more investments in M&A, Capex, and R&D for many U.S. corporations. Tech stocks such as FAMGA (aka Facebook, Apple, Microsoft, Google, and Amazon) are likely to benefit most from this tax reform by repatriating offshore cash stockpiles to invest in U.S. job creation, robotic manufacturing automation, and more patent-intensive tech-savvy development in artificial intelligence, cloud software development, virtual reality, and network platform orchestration.

The ripple effect manifests in the subsequent Fed interest rate hike, greenback appreciation, and positive stock investor sentiment. All of these probable macro ramifications contribute to an upward GDP growth trajectory toward the Trump administration's 2.7%-3.3% target range.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2019-01-12 10:33:00 Saturday ET

With majority control, House Democrats pass 2 bills to reopen the U.S. government without funding the Trump border wall. President Trump makes a surprise Wh

2017-04-25 06:35:00 Tuesday ET

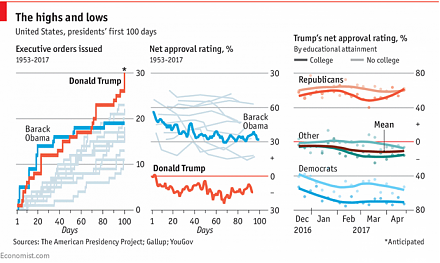

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl