2017-10-03 18:39:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's strategic decision is unlikely to disturb the current roaring stock market. Powell will probably maintain monetary policy continuity with a dovish stance of slow and gradual interest rate acceleration. This dovish stance not only extends the gradual interest rate hike, but also accommodates sluggish manufacturing work recovery, low wage growth, and wider diffusion of digital technology usage in America.

The Trump administration targets 3% GDP growth and 2% inflation for household and corporate tax incentives to meet fiscal neutrality. Powell has risen to the challenge of competing with several contenders for the top post of Federal Reserve: Janet Yellen (incumbent), John Taylor (Stanford professor), Gary Cohn (White House chief economist), and Kevin Warsh (former governor). Powell's inclination toward more pervasive financial deregulation is a primary advantage for Trump's calculus. Others warn that the likely imbalance between inflation containment and employment growth may cause distortions in the U.S. economy. In essence, monetary policy continuity trumps contractionary monetary policy normalization under the current Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-19 09:38:00 Monday ET

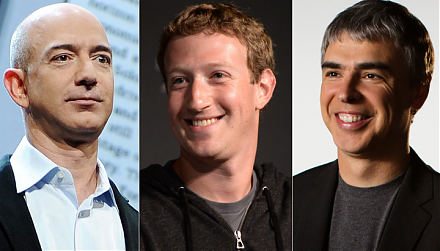

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2017-12-23 10:40:00 Saturday ET

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2018-09-25 10:35:00 Tuesday ET

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide.

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

2025-10-03 10:31:00 Friday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund