2017-10-03 18:39:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's strategic decision is unlikely to disturb the current roaring stock market. Powell will probably maintain monetary policy continuity with a dovish stance of slow and gradual interest rate acceleration. This dovish stance not only extends the gradual interest rate hike, but also accommodates sluggish manufacturing work recovery, low wage growth, and wider diffusion of digital technology usage in America.

The Trump administration targets 3% GDP growth and 2% inflation for household and corporate tax incentives to meet fiscal neutrality. Powell has risen to the challenge of competing with several contenders for the top post of Federal Reserve: Janet Yellen (incumbent), John Taylor (Stanford professor), Gary Cohn (White House chief economist), and Kevin Warsh (former governor). Powell's inclination toward more pervasive financial deregulation is a primary advantage for Trump's calculus. Others warn that the likely imbalance between inflation containment and employment growth may cause distortions in the U.S. economy. In essence, monetary policy continuity trumps contractionary monetary policy normalization under the current Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-13 07:42:00 Monday ET

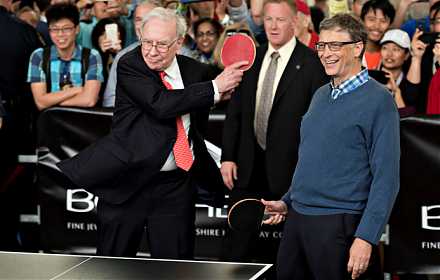

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2018-06-10 19:41:00 Sunday ET

Apple enters a multi-year content partnership with Oprah Winfrey to provide new original online video and TV programs in direct competition with Netflix, Am

2026-10-31 12:38:00 Saturday ET

Today tech titans and billionaires continue to reshape global pharmaceutical investments for both better healthspan and longer lifespan. We discuss, desc