2018-03-25 08:39:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U.S. exports. This strategic move hits China for its unfair trade practices with at least 3 major jabs. First, the Trump tariffs take the form of 25% key duties on $60 billion Chinese exports to America. This jab is only a fraction of the economic collateral damage that China has done to America by forcibly extracting the intellectual properties of U.S. corporations.

Second, the Trump administration can introduce foreign investment restrictions on Chinese companies. This prevention can stop Chinese companies from swooping into U.S. competitive advantages.

Third, the Trump team considers litigation at the World Trade Organization (WTO). Since the inception of its WTO membership, China has indeed failed to transform into an open democratic society that respects both economic freedom and the rule of law.

Overall, the Trump tariffs signal the dawn of an inevitable Sino-American trade war. Trump uses the sequential tariff tactics and economic sanctions on China, Iran, and Russia and even some western allies such as Canada, Europe, and Mexico. These tactical solutions may help reduce U.S. trade and budget deficits.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-07 07:34:00 Wednesday ET

President Trump tweets his key decision to oust State Secretary Rex Tillerson after several months of intense disagreement over diplomatic affairs. Trump so

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2018-09-15 11:35:00 Saturday ET

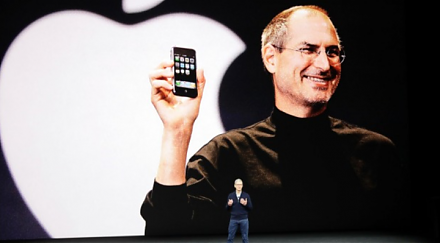

Apple releases its September 2018 trifecta of smart phones or iPhone X sequels: iPhone Xs, iPhone Xs Max, and iPhone XR. Both iPhone Xs and iPhone Xs Max ha

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi