2018-10-21 14:40:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Trump floats generous 10% tax cuts for the U.S. middle class ahead of the November 2018 mid-term elections. Republican senators, congressmen, and congresswomen can propose massive tax cuts for middle-income Americans. This time may be a bit different, and President Trump expects the tax bill to go through Congress but not an executive order. The Trump administration suggests that the legislative vote will likely take place soon after the mid-term elections. The strategic move boosts confidence in the Republican lawmakers who can continue to control Congress. Treasury Secretary Steven Mnuchin cannot offer details on the middle-income tax brackets that can experience lower effective tax rates. This tax bill may add to the prior $1.5 trillion tax cuts and $779 billion fiscal deficits.

Republican leaders and senators emphasize that this tax bill will finance itself with better real GDP economic growth in the healthy upper range of 3%-4%. The Trump administration can offset these new tax cuts with lower government expenditures in Medicare, Medicaid, and social security. Alternatively, the Trump administration can raise effective tax rates for most rich Americans in the top 1% socioeconomic echelon to partially offset the new tax cuts for the U.S. middle-class.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-03-05 08:28:00 Thursday ET

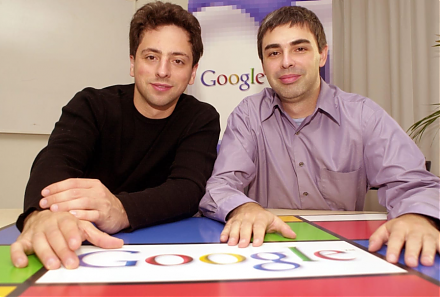

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m

2024-03-19 03:35:58 Tuesday ET

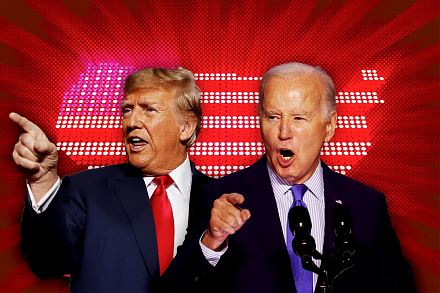

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2019-06-21 13:33:00 Friday ET

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement