2019-02-06 10:36:49 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President Trump praises the current 2-year U.S. economic boom and stock market rally. As Trump remains upbeat about the current U.S. economic outlook, several sectors such as big pharma, transport, and technology benefit much from the current stock market rally. Second, the Trump team seeks a bipartisan solution to public finance for his southern border wall for better immigration. President Trump may find it difficult to compromise on this fiscal issue in the near-term.

Third, Trump aims to implement a structural change to unfair trade practices and chronic trade imbalances in the current trade war resolution with China. The next summit between Presidents Trump and Xi can reach important trade war resolution soon after Trump shakes hands with the North Korean leader Kim Jung-Un in the historic forum in Vietnam in late-February 2019. Fourth, Trump asks Congress to pass the current bill for new infrastructure with more than $1 trillion fiscal finance. Fifth, Trump vows to help reduce astronomical medical costs and drug prices in America. Through his second state-of-the-union address, President Trump now seeks to make progress on these socioeconomic issues.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-02 10:31:00 Sunday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2018-08-31 08:42:00 Friday ET

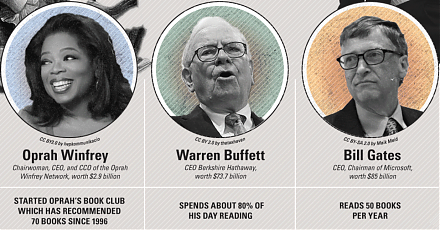

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2017-11-29 07:42:00 Wednesday ET

The octogenarian billionaire and activist investor Carl Icahn mulls over steps to shake up the board of SandRidge Energy after the oil-and-gas company adopt

2019-10-27 17:37:00 Sunday ET

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-autho