2019-02-06 10:36:49 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President Trump praises the current 2-year U.S. economic boom and stock market rally. As Trump remains upbeat about the current U.S. economic outlook, several sectors such as big pharma, transport, and technology benefit much from the current stock market rally. Second, the Trump team seeks a bipartisan solution to public finance for his southern border wall for better immigration. President Trump may find it difficult to compromise on this fiscal issue in the near-term.

Third, Trump aims to implement a structural change to unfair trade practices and chronic trade imbalances in the current trade war resolution with China. The next summit between Presidents Trump and Xi can reach important trade war resolution soon after Trump shakes hands with the North Korean leader Kim Jung-Un in the historic forum in Vietnam in late-February 2019. Fourth, Trump asks Congress to pass the current bill for new infrastructure with more than $1 trillion fiscal finance. Fifth, Trump vows to help reduce astronomical medical costs and drug prices in America. Through his second state-of-the-union address, President Trump now seeks to make progress on these socioeconomic issues.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia

2023-07-21 10:30:00 Friday ET

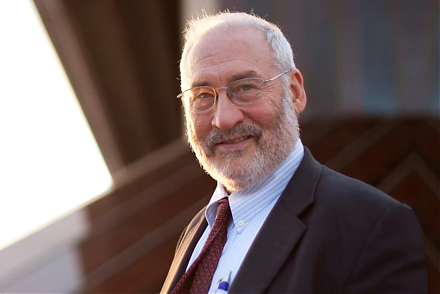

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa