2018-01-10 08:40:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

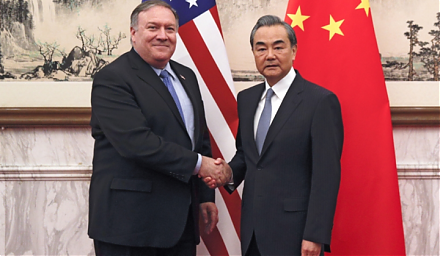

President Trump considers imposing retaliatory economic sanctions on Chinese products and services in direct response to China's theft and infringement of U.S. intellectual property. Trump's retaliatory trade sanctions may involve tariffs, quotas, embargoes, and other restrictions on China's investments in U.S. companies. This punitive penalty arises as part of a recent Trade Act Section 301 probe into China's recent regulations that induce U.S. multinational corporations to establish onshore IT data centers. These regulations force unfair intellectual property and technology transfer from these U.S. multinational corporations to their Chinese counterparts. Without such technology transfer, the use and implementation of U.S. patents and trademarks would otherwise involve egregious infringement at the expense of U.S. firms and other innovators.

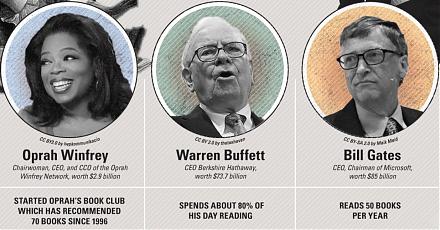

Recent empirical evidence suggests that this unfair technology transfer may be the root cause of both billions of dollar losses in corporate revenue as well as millions of job losses in America. In addition to intellectual property theft and infringement, the Trump administration also accuses China of currency manipulation. Over the years, China has been accumulating substantial dollar reserves in the form of U.S. Treasury bonds for better renminbi devaluation. This deliberate devaluation leads to more competitive Chinese export prices and thus better low-cost product sales abroad. The Trump administration needs to consider retaliatory trade sanctions on China in order to eradicate trade deficits with better fiscal discipline.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-02-01 07:38:00 Thursday ET

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries t

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2019-10-01 11:33:00 Tuesday ET

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2022-11-15 10:30:00 Tuesday ET

Stock market misvaluation and corporate investment payout The behavioral catering theory suggests that stock market misvaluation can have a first-order