2018-10-13 10:44:00 Sat ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-October 2018. President Trump blames the Federal Reserve for its *crazy tight* interest rate hike. However, this criticism may not be the main trigger for bearish massive stock sell-off. The relentless Sino-American trade impasse remains on the radar for stock market investors. Also, the 10-year Treasury bond yield rises above 3%, and then many institutional investors switch from stock bets to Treasury bond purchases.

Due to these unforeseen circumstances, the International Monetary Fund (IMF) downgrades global economic growth from 3.9% to 3.7% as of October 2018. This latter downgrade seems to trigger ubiquitous investor panic that manifests in the recent surge of the CBOE volatility index (VIX) well beyond 22 points.

Treasury Secretary Steven Mnuchin views the severe bloodbath from S&P 500 to NASDAQ as a normal stock market correction. Mnuchin considers this widespread stock market correction as part of the healthy fundamental recalibration primarily for tech titans such as Facebook, Apple, Microsoft, Google, Amazon, Netflix, and Twitter (FAMGANT). These tech titans exhibit prior stock market overvaluation in the interim period from late-2017 to early-2018.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2026-02-28 10:29:00 Saturday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. As of March 2026, we have up

2019-03-15 13:36:00 Friday ET

CNBC stock host Jim Cramer recommends both Caterpillar and Home Depot as the U.S. bull market is likely to continue in light of the recent Fed Chair comment

2025-10-07 10:30:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-09-14 09:28:00 Thursday ET

Colin Camerer, George Loewenstein, and Matthew Rabin assess the recent advances in the behavioral economic science. Colin Camerer, George Loewenstei

2023-11-14 08:24:00 Tuesday ET

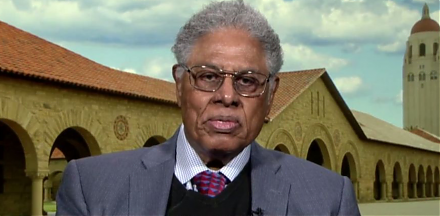

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo