2018-03-05 07:34:00 Mon ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Peter Thiel shares his money views of President Trump, Facebook, Bitcoin, global finance, and trade etc. As an early technology adopter, Thiel invests in Facebook and Bitcoin. The former connects people with better social integration around the world, and the latter offers a new crypto medium of exchange for online payments. Network effects breed positive feedback loops, whereas, there is a critical inflection point where these network effects fall over into the madness of crowds. As one of the co-founders for PayPal and Palantir, Thiel thinks it is important to ensure third-party payment security for safer cross-border finance and trade.

Thiel supports President Trump because his economic policy reform helps avoid fake culture wars between different civilizations. Trump tax cuts and infrastructure expenditures help boost American household consumption, firm production, and financial intermediation. In light of antitrust investigations into Google and some other Silicon Valley tech firms, Thiel considers these firms in trouble as subsequent government regulation looms as a major business risk. As a serial entrepreneur, Thiel emphasizes the importance of ambition that transcends just making money for a company. Disruptive innovation not only replaces prior technology, but also significantly improves and enriches the economic lives of others.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-23 10:42:00 Thursday ET

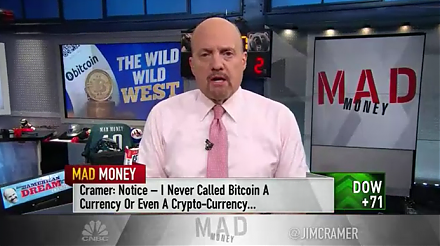

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2017-11-24 08:41:00 Friday ET

Is Bitcoin a legitimate (crypto)currency or a new bubble waiting to implode? As its prices skyrocket, bankers, pundits, and investors increasingly take side

2019-08-01 11:33:00 Thursday ET

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. po

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-11-28 11:35:00 Tuesday ET

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms. D