2018-05-11 09:37:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2018. Also, President Trump has withdrawn America from the key multilateral Iran nuclear deal and thus revives draconian economic sanctions on Iran.

Saudi Arabia may deliberately boost short-term oil prices in order to support the Aramco IPO in 2019. These major geopolitical events sustain the recent oil price increase in the medium term.

Several economic news sources such as Forbes, CNBC, Bloomberg, Reuters, and The Economist suggest that the new target oil price range is $80-$95 per barrel in the next 18 months. Many market observers suggest that the geopolitical concerns seem to outweigh demand-supply adjustments in relative importance at least over the short-to-medium run.

U.S. inflation expectations gravitate toward the 2% target inflation rate. A further interest rate hike may be plausible such that the neutral interest rate helps contain inflationary pressures near full employment. These financial market developments have important monetary policy implications for U.S. firms, financial intermediaries, consumers, producers, and stock market investors etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant

2019-05-09 10:28:00 Thursday ET

President Trump ramps up 25% tariffs on $200 billion Chinese imports soon after China backtracks on the Sino-American trade agreement. U.S. trade envoy Robe

2017-10-21 08:45:00 Saturday ET

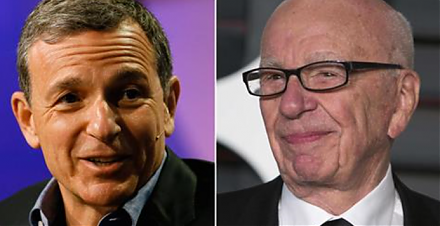

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila