2018-05-11 09:37:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2018. Also, President Trump has withdrawn America from the key multilateral Iran nuclear deal and thus revives draconian economic sanctions on Iran.

Saudi Arabia may deliberately boost short-term oil prices in order to support the Aramco IPO in 2019. These major geopolitical events sustain the recent oil price increase in the medium term.

Several economic news sources such as Forbes, CNBC, Bloomberg, Reuters, and The Economist suggest that the new target oil price range is $80-$95 per barrel in the next 18 months. Many market observers suggest that the geopolitical concerns seem to outweigh demand-supply adjustments in relative importance at least over the short-to-medium run.

U.S. inflation expectations gravitate toward the 2% target inflation rate. A further interest rate hike may be plausible such that the neutral interest rate helps contain inflationary pressures near full employment. These financial market developments have important monetary policy implications for U.S. firms, financial intermediaries, consumers, producers, and stock market investors etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2017-07-01 08:40:00 Saturday ET

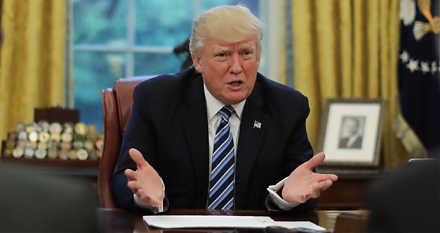

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2017-11-29 07:42:00 Wednesday ET

The octogenarian billionaire and activist investor Carl Icahn mulls over steps to shake up the board of SandRidge Energy after the oil-and-gas company adopt

2018-12-18 10:38:00 Tuesday ET

President Trump threatens to shut down the U.S. government in 2019 if Democrats refuse to help approve $5 billion public finance for the southern border wal