2019-03-27 11:28:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction and uncertainty amid the recent Sino-U.S. trade and Brexit standoffs. Moreover, OECD downgrades real GDP growth rates from 6.5% to 6% for China and from 1.5% to 1% for Europe. The Chinese Xi administration attempts to assuage U.S. concerns about the bilateral trade deficit, unfair technology transfer, and intellectual property protection. Meanwhile, the British May administration seeks to delay Brexit to buy extra time for a plausible second referendum on whether the U.K. should leave the European trade bloc. These trade issues can cloud macroeconomic momentum in Europe and East Asia.

Several chief economists recommend the European and Asian central banks not to follow the Federal Reserve interest rate hikes too soon. To the extent that these non-American central banks decelerate the global financial cycle with less hawkish monetary policy adjustments, Europe and East Asia can insulate themselves from volatile exchange rates, stock market gyrations, and cross-border capital flows that might arise from the next Federal Reserve interest rate decisions. The subsequent international interest rate increases are likely to reflect recent upticks in consumer confidence, wage growth, and core inflation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2025-10-06 10:27:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-11-23 10:42:00 Thursday ET

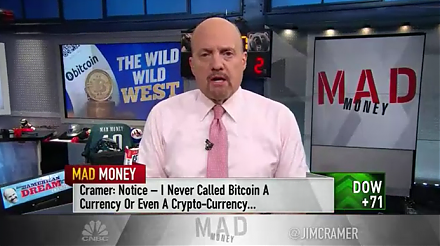

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2022-05-25 09:31:00 Wednesday ET

Net stock issuance theory and practice Net equity issuance can be in the form of initial public offering (IPO) or seasoned equity offering (SEO). This l

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl