2019-01-07 18:42:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on government intervention as the primary root cause of socioeconomic malaise in several OECD countries. Ideology continues to inform public policy, and neoliberalism specifically advocates a minimal role for the state in economic affairs such as taxation, health care, trade, infrastructure, and immigration. Neoliberal public choice emphasizes regulatory failures rather than historical country-specific experiences.

The sheer predominance of utilitarian myopia reflects fundamental misconceptions about the proper role of government. Contrary to the post-crisis consensus, active strategic public-sector investment is critical to both economic revival and financial stability. The state should act as an investor of first resort, rather than a lender of last resort, for greater tech advances and revolutions in finance, energy, transport, medicine, and information communication. The government can learn much from the best business minds of Warren Buffet and George Soros in finance, Elon Musk in energy and autonomous transport, Peter Diamandis and James Brewer in health care and medicine, as well as Steve Jobs, Tim Cook, Bill Gates, Larry Page, and Jeff Bezos in information communication technology. Effective capitalism calls for facilitative state involvement in economic governance and regulation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-13 11:00:00 Wednesday ET

President Trump may reluctantly sign the congressional border wall deal in order to avert another U.S. government shutdown. With his executive power to decl

2017-12-01 06:30:00 Friday ET

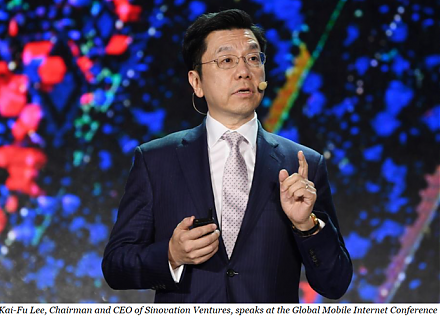

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs

2018-06-29 11:41:00 Friday ET

Amazon acquires an Internet pharmacy PillPack in order to better compete with Walgreens Boots Alliance, CVS Health, Rite Aid, and many other drug distributo

2020-02-12 09:31:00 Wednesday ET

Mark Zuckerberg develops Facebook as a social network platform to help empower global connections among family and friends. David Kirkpatrick (2011) T