2018-01-19 11:32:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation, healthy fundamental recalibration, job creation, high productivity, and artificial-intelligence automation. For instance, the U.S. economy operates near full employment with 1.5%-2% moderate inflation, $2.5 trillion mandatory government expenditures, and $1.5 trillion tax cuts. Also, Europe now feels the benign effects of easy money that arises from the European Central Bank's (ECB) quantitative-easing and negative-interest-rate monetary policies. Asian economies such as Hong Kong, Singapore, South Korea, and Taiwan experience economic revival due to the global upstream prosperity of Apple-and-Samsung-driven mobile device production.

Key recent oil price increases boost economic gains for Russia, Saudi Arabia, and other middle-east producers. Meanwhile, Brazil still suffers the ripple effects of a veritable depression and now flashes tentative signs of macroeconomic recovery with high population dividends.

However, several other economies exhibit weak macro momentum with chaotic bouts of economic policy uncertainty. England now has to confront high unstable exchange rates, wide stock market gyrations, and trade barriers in the post-Brexit investment horizon. China may land hard with sub-6% real GDP economic growth due to the potential Sino-American trade war. Mexico may fail to transcend fears and doubts that the Trump team menaces its recent economic convalescence with hefty tariffs and border taxes.

The International Monetary Fund (IMF) predicts 2.7%-3% U.S. real GDP economic growth and 3.7%-3.9% economic growth worldwide. IMF research now warns of economic inequality, cybersecurity, extreme weather, and political confrontations such as U.S.-Korean nuclear threats and fair trade barriers.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-06-13 10:26:00 Thursday ET

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs

2017-03-15 08:46:00 Wednesday ET

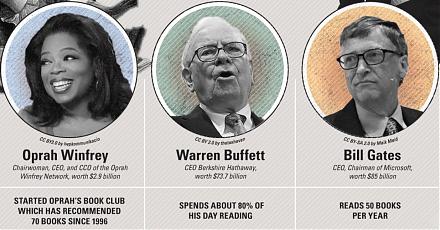

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement