2019-09-01 10:31:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances represent a major persistent challenge to most recent artificial intelligence applications such as Apple Siri, Amazon Alexa, and Google Assistant etc. For instance, artificial intelligence applications often cannot decipher puns, jokes, sarcastic remarks, and other more complex conversations. Artificial intelligence applications often cannot distinguish delicate human facial expressions such as surprise and confusion, fear and anxiety, or hubris and hysteria.

Many artificial intelligence machines learn from big data to predict specific human emotions, actions, and interactive outcomes via neural networks. Primary emotion recognition technology analyzes facial expressions to infer how humans feel, and this technology can create $25 billion business opportunities by 2025. Tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.) lead these tech advances in artificial intelligence. New lean specialty startups such Kairos and Affectiva also take part in this fresh unique direction. Emotion recognition can often help promote products and services, and this new technology can be useful in job recruitment, fraud, and crime prevention. Several lean enterprises seek to capture this tech niche, and these enterprises have yet to close the gap between artificial intelligence and universal intelligence.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-29 08:35:00 Monday ET

IMF chief economist Gita Gopinath predicts no global recession with key downside risks at this delicate moment. First, trade tensions remain one of the key

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2016-10-01 00:00:00 Saturday ET

We can learn much from the frugal habits and lifestyles of several billionaires on earth. Warren Buffett, Chairman and CEO of Berkshire Hathaway, still l

2018-01-02 12:39:00 Tuesday ET

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-1

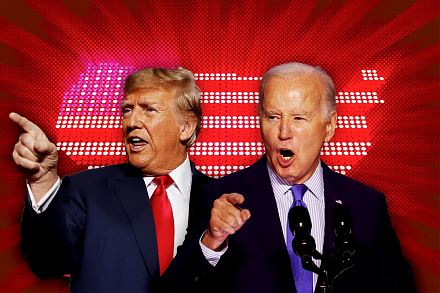

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2023-10-19 08:26:00 Thursday ET

World politics, economics, and new ideas from the Psychology of Money written by Morgan Housel We would like to provide both economic and non-economic th